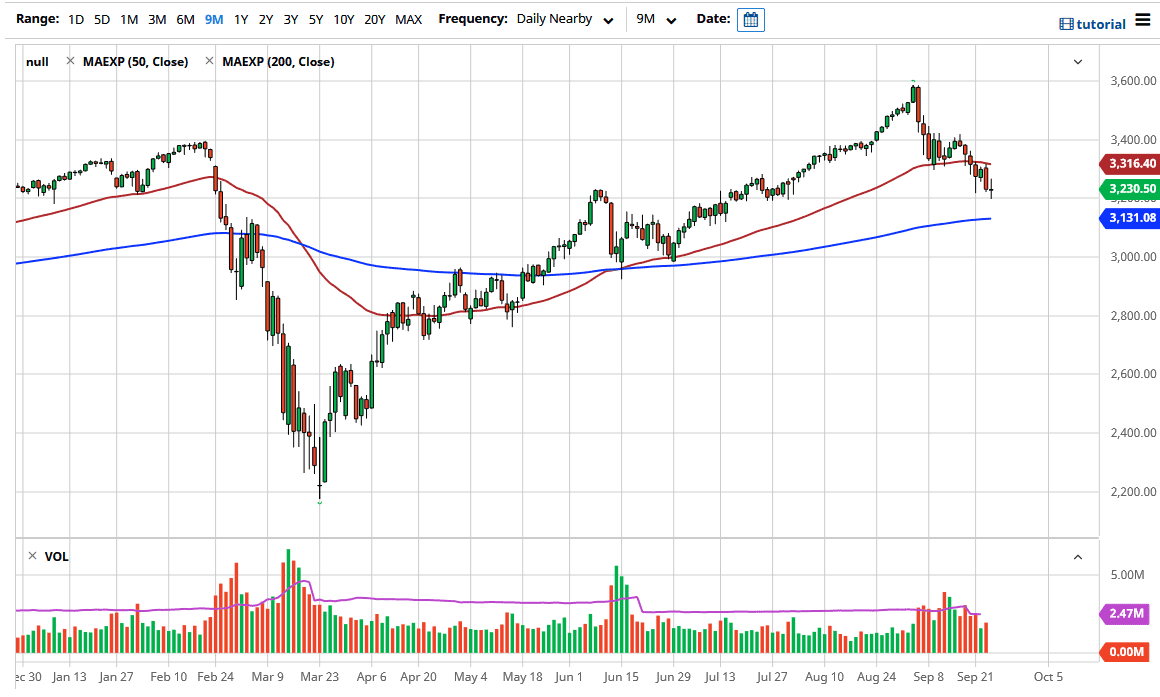

The S&P 500 has gone back and forth during the trading session on Thursday to form a neutral candlestick, which of course is somewhat bullish considering how the market has behaved recently. Because of this, I think the market is obviously paying attention to the 3200 level, an area that has been important in the past, as it was the scene of a big break out. It should now be supporting all things being equal, especially if the market is going to stay in a longer term uptrend. Ultimately though, we could drop even below there and if we do then I would be looking at the 200 day EMA next.

The stock market is basically moving based upon political noise coming out of Washington DC, and a lack of stimulus. Furthermore, a lot of option buying that had been driven by retail traders as of late has disappeared, and that has worked against the value of the S&P 500 as well. Now that catalyst is gone, we need to find another reason to get long of the stock market. As long as the US dollar continues to strengthen, that will be a bit of a headwind for the market, but if the greenback sells off on Friday, and it looks like it could, that might cause a little bit of a bounce. I suspect that a bounce is going to be sold into, but the next 24 hours might be a little bit of a recovery session.

Alternately, if we do get the breakdown below the 3200 level there will probably be a big move towards the 200 day EMA, perhaps even the 3100 level. A break down below there then speeds up the deceleration to the 3000 and a lot of people would become very nervous at that point. I think that the S&P 500 is currently at an area where we need to make a decision in one way or the other, as to where the next 200 points are going to be found. Friday will probably be a bit noisy, but do not be surprised at all if people are not willing to carry risk into the weekend. In other words, we could get a very similar day to Thursday but regardless I think you are probably better off waiting to see which direction we break from the range that made up the daily candlestick on Thursday.