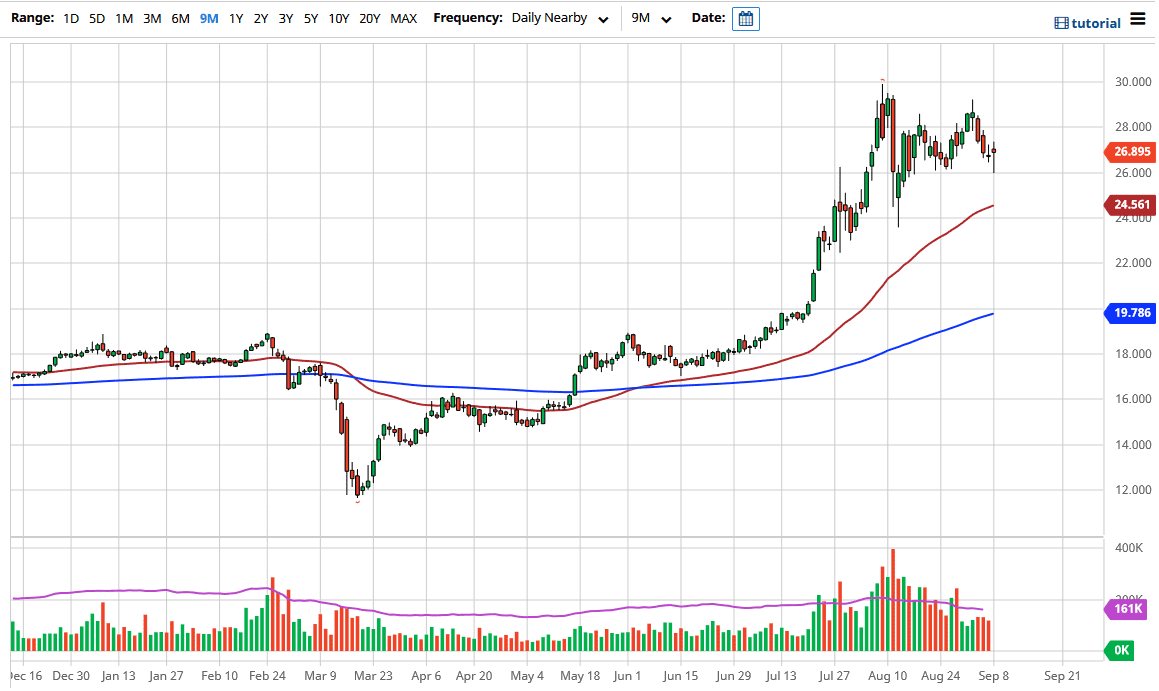

Silver markets were all over the place during the trading session on Tuesday as traders came back to work. Ultimately, we have seen the market going higher, reach towards the upside, but then broke down significantly towards the $26 level. That is an area that continues to find buyers, and I also believe that there is significant support underneath near the $25 level as the 50 day EMA goes reaching towards it. We are still very much in an uptrend and even though it was a horrific day to be trading silver, the reality is that we have held.

Looking at this chart, it is in an uptrend regardless, and it is worth noting that we recovered quite nicely. Because of this, it does suggest that we will eventually see an attempt to get back in favor and go towards the $28 level. As far as shorting this market is concerned, it is not until we break down below the $24 level that I would be looking to short this market, and at that point, I think that we could drop as low as the $20 level. That is an area that should be rather supportive and structurally important as it was where we broke out above. Ultimately, the market is likely to see a lot of volatility if we do break down, and it will probably be very difficult to hang onto. Keep in mind that the US dollar is a major driver of where this market will go, so that is also worth paying attention to.

If the US dollar rises, then it tends to work against the silver market as well as the gold market. After all, commodity markets are priced in greenbacks, so if the US dollar rallies it means that it takes less of them to buy that commodity. The candlestick is a hammer though, and that does suggest that we are likely to see a lot of bullish pressure. I think the next couple of days will be very noisy, so be cautious with your position size, as silver is choppy and cannot move quite rapidly under normal circumstances, let alone what we have been seeing lately. If we can finally break above the $30 level, that will kick off another leg higher, reaching towards the $50 eventually, as it tends to do once we get above the $30 level.