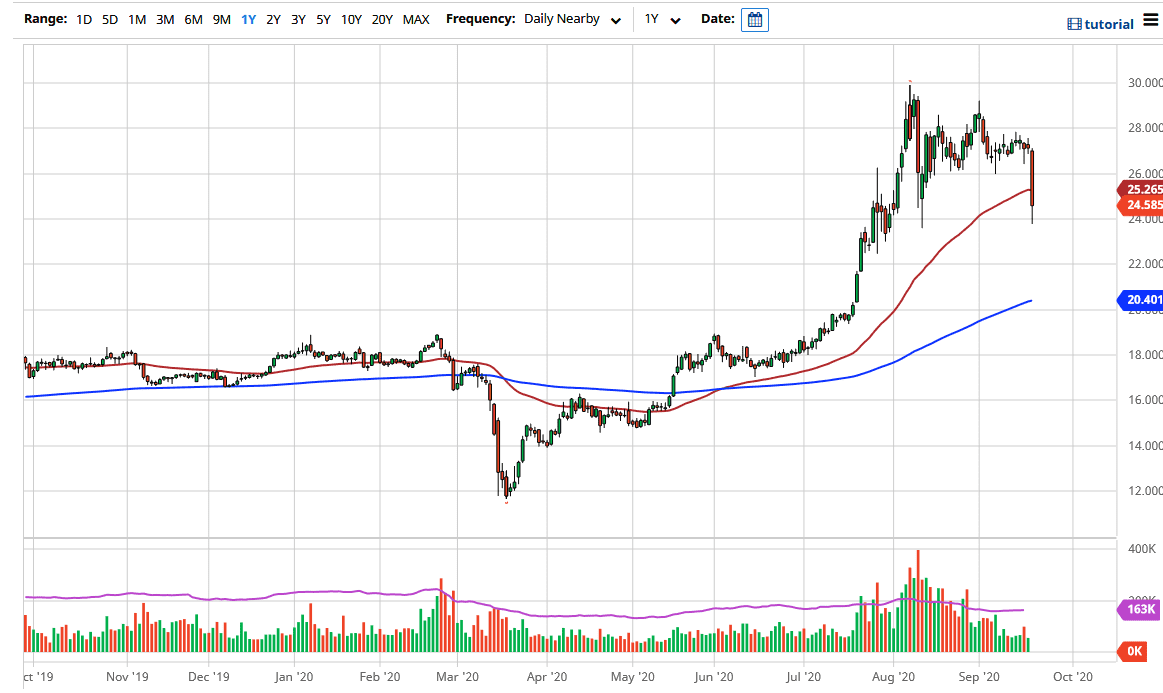

Silver markets broke significantly to the downside during the day on Monday, slicing through the $26 level. Most of this was due to the US dollar strengthening against almost everything, which has had its value crushed due to the fact that it is priced in US dollars. The $24 level was tested but it looks as if it is trying to offer a bit of support at this point in time, but it should be noted that the body of the candlestick is rather large, so I think it is only a matter of time before the sellers return.

This brings up an interesting issue, mainly because although silver is most certainly in an uptrend from a longer-term standpoint, it looks very likely that we are going to continue to at least try to break down, and if we do in fact break down from here, I think that the 200 day EMA could be coming into play, which is closer to the $20.40 level. Underneath there, then the $20 level has significance as well, and I think that would be whether buyers would be looking at based upon the fact that we have broken out at that level.

To the upside, I suspect that the $26 level above should offer resistance because it was previously supportive. This follows the “what was once support now becomes resistance” theme, so at this point, I think it will be interesting to see what happens in that general vicinity. You need to pay attention to the US dollar overall, and that will tell you where we go next in the silver market. If we do break down below here, then it is simply a matter of standing on the sidelines and waiting for some type of supportive candlestick in order to get involved and buy silver “on the cheap.”

Do not get me wrong, I think that this market will go higher over the longer term, but right now it looks as if we have a lot of negative pressure that we need to be aware of, and the markets will be paying close attention to risk appetite. Currently, the US dollar is in the lead and that puts silver on the back burner. I will be looking for buying opportunities underneath, but it will be based upon daily candlesticks that close with strength.