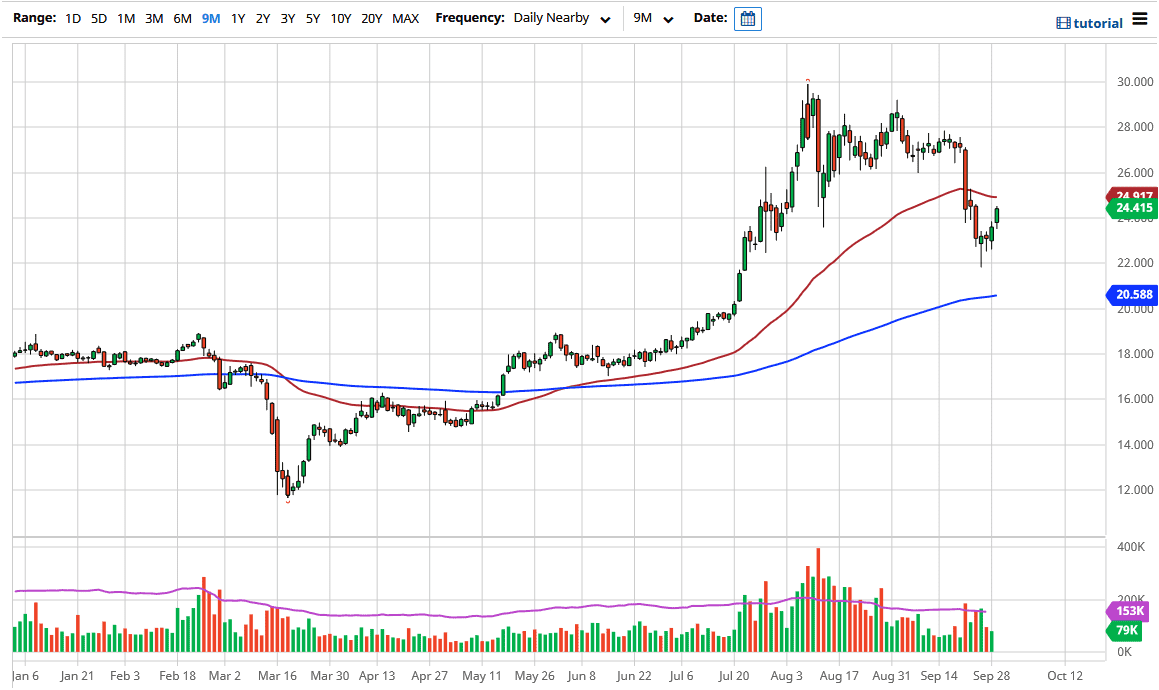

The silver markets gapped higher to kick off the trading session on Tuesday and broke even higher to reach towards the $24.40 level by the time the open outcry session ended. Having said that, the market looks very likely to see continued pressure to the upside, perhaps reaching towards the $25 level. That is an area that also will attract a lot of attention due to the fact that it is a large, round, psychologically significant figure, and we also have the 50 day EMA sitting just below there.

Looking at this chart, if we were to break above there then we could go looking towards the $26 level, followed very closely by the $27 level where we have seen a massive amount of selling. Pay attention to the US dollar, due to the fact that the silver market tends to move in the opposite direction. The US dollar falling makes owning silver cheaper, due to the fact that it takes less of those US dollars to buy an ounce.

Looking at the chart, it certainly looks as if it is being constructive, but I think that a pullback is only going to be a buying opportunity. The $22 level has been a massive support, as we have bounced from there. Having said that, if the market breaks down below the $22 level, become even more interested near the 200 day EMA which is at the $20.58 level, and then possibly even the $20 level underneath. Looking at this chart, I have no interest in shorting this, because the central banks out there printing currency the way they are, it does make sense that certain hard assets such as silver will continue to find buyers. Commodities, in general, will benefit from lower US dollars, but there is also the possibility that people will buy precious metals as a bit of a safety trade also. I do not have a scenario where I am going to be a seller, at least not anytime soon, and at least not until we break significantly below the $20 level. I do believe that eventually, we break above $30, but that probably takes quite a while. I do not like the idea of an impulsive move to the upside because volatility gets more volatility. This is especially true in the silver market which tends to be thinner than the gold market.