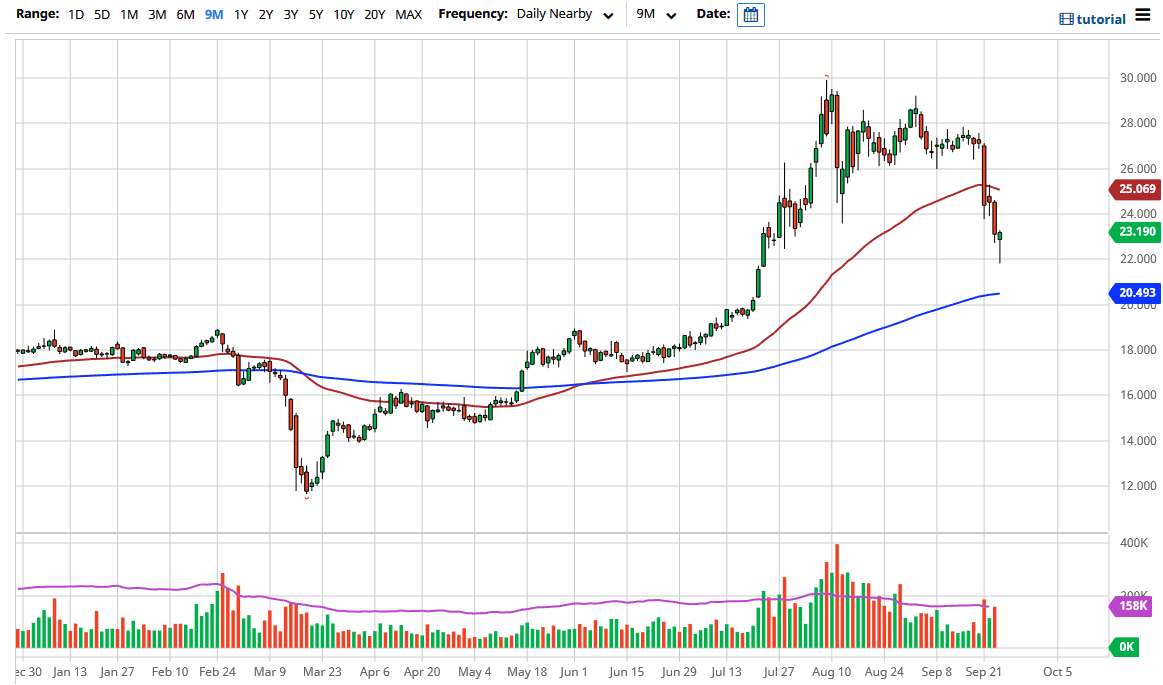

Silver markets have initially fallen during the trading session on Thursday to reach down towards the $22 level. This is an area that could be somewhat supportive, but I would not be a huge buyer quite yet, because quite frankly we have seen a lot of damage and it is important to notice that the $22 level is not a major demand area per se. I believe at this point it is likely that we will continue to see a lot of back-and-forth and perhaps concerns about the US dollar. The US dollar had gotten a bit over bought, so it does make sense that we have seen a bit greenback selling during the day.

As the US dollar loses value, it takes more of those US dollars to buy silver. This is true with all commodities, so it does make sense that this one follows right along with the rest. Regardless, I am not quite ready to start buying but I am the first person to point out that this is a hammer, and that in and of itself is a relatively bullish sign. However, I would be much more comfortable buying silver closer to the $20 level, because not only do we have the 200 day EMA but it was also the scene of a major breakdown. You could make an argument here though that the market is ready to continue the longer-term trend, so I am not against buying, I just prefer a little bit more in the way of stability before putting money to work. If you were to be buying silver at this point, it is probably prudent to make sure that you scale into a position, not necessarily look to jump in and start piling on.

A breakdown below the bottom of the candlestick for the trading session on Thursday opens up another to dollar move, but silver has been extraordinarily oversold this past couple of days, so a bounce certainly makes quite a bit of sense. I still think we go lower, so a bounce and then selling is also possible. (You should take a look at the EUR/USD chart, it sets up very similarly.) With that being the case, I think a short-term bounce and then perhaps rooting around for some type of longer-term support is what we are about to see. Follow the US dollar, it will lead the way.