We have formed a massive hammer, and that of course is a very bullish sign. That being said, the silver markets also face a lot of resistance above at the $20 level so unless we get some type of major breakdown in the US dollar, it is very unlikely to suddenly take off. In fact, you can almost draw all a bit of a correlation between this market and the EUR/USD pair, which looks very similar during the day.

All this tells me is that silver is trading on one thing and one thing only: the US dollar. With that in mind, the US dollar does look as if it is trying to find a bit of a base on the US Dollar Index, at least from a weekly trendline. If it does in fact recover, then silver will more than likely get hit rather hard. This does not necessarily mean that silver will collapse, just that it will be very negative for the markets.

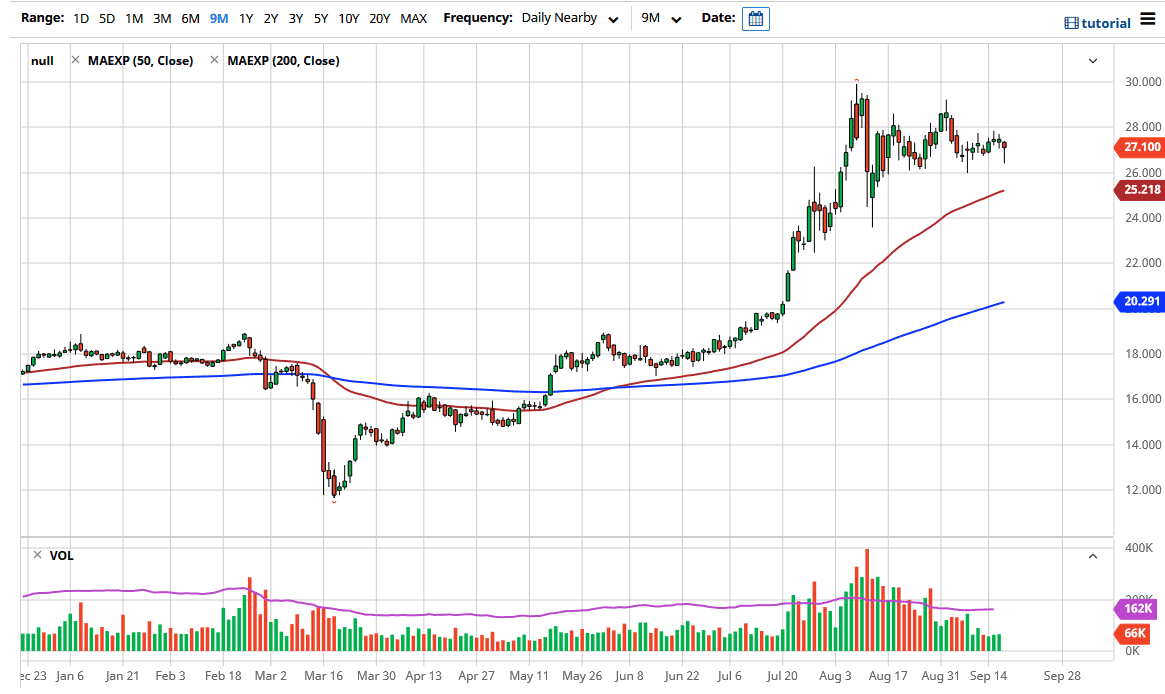

Longer-term, I do like silver and if we did break down a bit, I would be looking to buy silver at lower levels. I think that the $26 level underneath is massively supportive, just as the 50 day EMA should near the $25.20 level. If we were to break through all of that, then we could drip down towards the 200 day EMA, and I would let it do so. At that point, I would be looking at silver as a potential value trade and be looking to buy-and-hold for some time. On the other hand, if we were to break above the $20 level, then it should go towards the $29 level, and then possibly even the $30 level where I see even more resistance. Break above that level has a huge buy-and-hold aspect to it as well and could send this market looking closer to the $50 level. That has happened a couple of times in the past, and was central banks around the world printing currency the way they are, it would not be a huge stretch to think that happens yet again. All things being equal, I am a buyer and not a seller, but I also recognize we may have some work to do to digest the gains from the massive move higher starting in June.