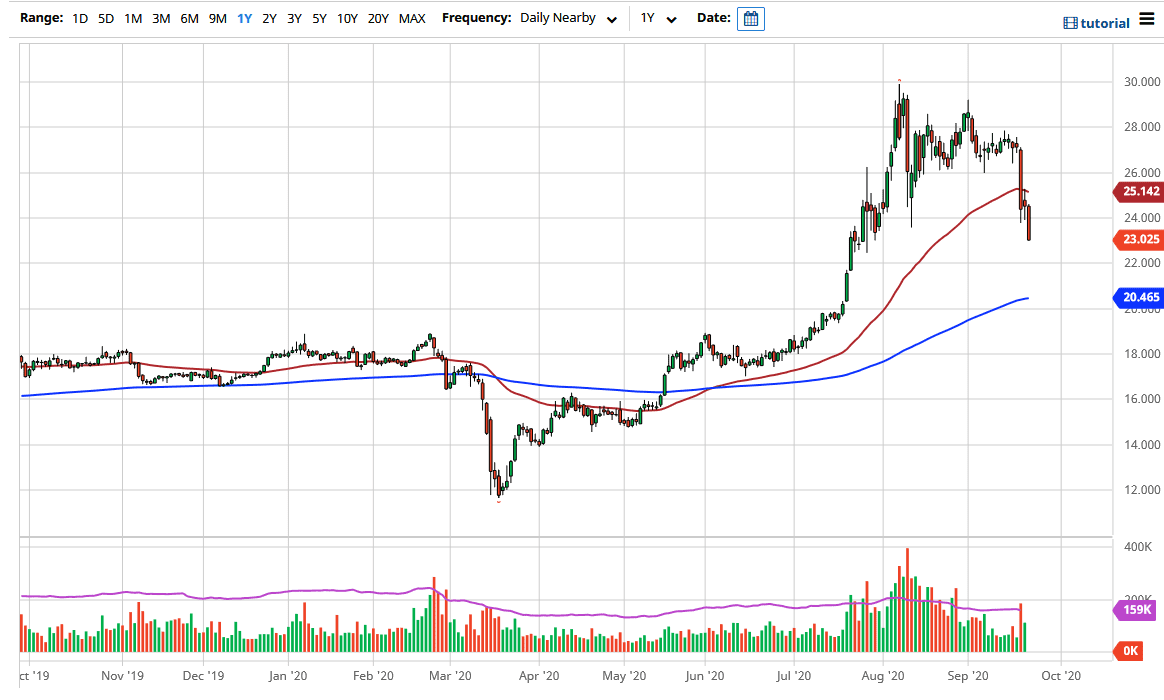

Silver markets have gotten absolutely killed during the trading session as the US dollar continues to strengthen. With this being the case, it is very likely that silver has further to go, and suddenly the US dollar is the only asset anybody wants to own. Clearly, there has been a major shift in attitude overall and I do think that it is only a matter of time before traders start looking towards the possibility of $22 silver, perhaps even the 200 day EMA underneath there.

Looking at the candlestick, it is huge, and it certainly is closing towards the bottom of the candlestick and that suggests that we probably have further negativity ahead. All things being equal though, I do think that silver offers a nice buying opportunity based upon support. The $22 level underneath is somewhat supportive, but I think that it is much more important to pay attention to the 200 day EMA and the $20 level. I think in that area we will have a lot of buyers just waiting to get involved, so pay attention to whether or not we get some type of supportive candlestick that we can take advantage of.

Ultimately, if we turn around a break above the $24 level, then it is likely that we go even higher. I suspect we probably have further to go in the meantime though, because this is a market that has got absolutely crushed, and at this point we have had another 6% loss. I look for the support underneath to take advantage of, because I do not have any interest in shorting silver. I am already long of the US dollar, so there is no need to “double my exposure” by shorting silver at the same time. Yes, I do believe that it is going to fall but I also believe in the longer-term efficacy of the uptrend, so I am waiting to see whether or not I get an opportunity to pick up silver “on the cheap.” Longer-term, I do think that we will return towards the $30 level but one of the biggest problem we have right now is that there is no inflation to be found, so precious metals are not getting that boost at the moment. At this point, silver looks absolutely horrible, but this is more than likely going to be a temporary situation.