The NASDAQ 100 lost about 5% at one point, and that was just the beginning of issues. Ultimately, I think that the market is still very much in an uptrend, so you need to look for some type of value to take advantage of. Underneath, the $26 level is a massive support level as we have seen previously, so I do think that it should offer a bit of a “floor the market.”

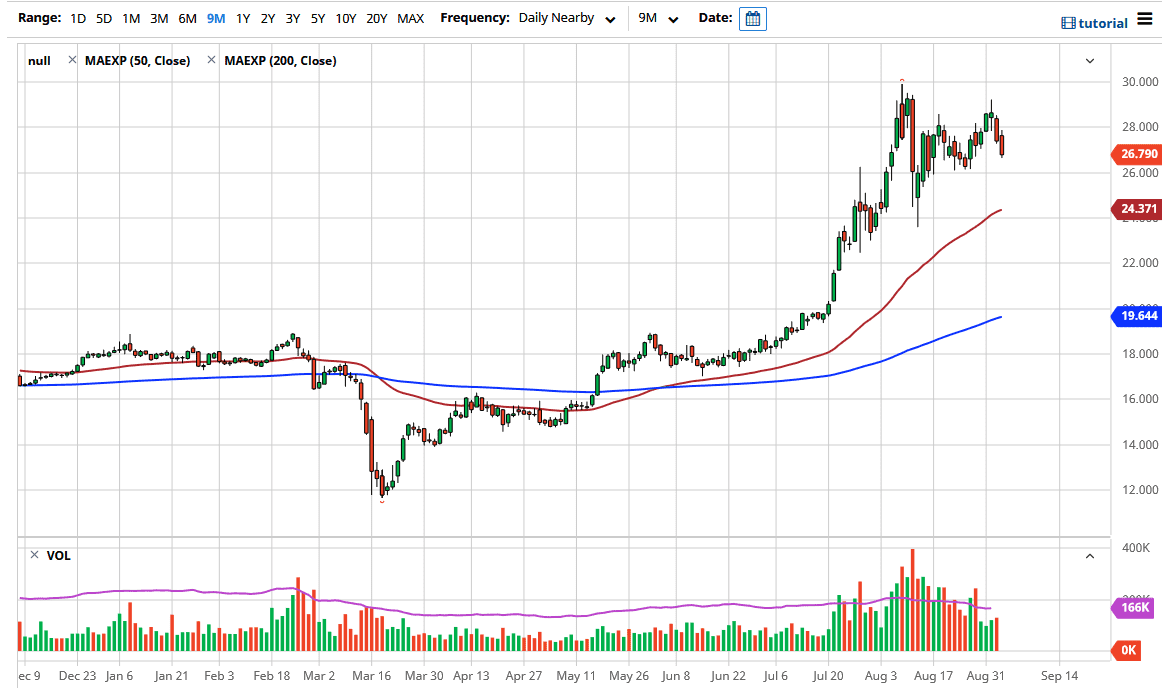

When you look at the silver market, you can see that we have been grinding higher in a bit of an ascending channel, and at this point not much has changed. The 50 day EMA looks like it is going straight towards the $25 level, and then eventually the $26 level. The candlestick of course is rather negative looking, and we are closing towards the bottom of the candlestick which typically means there is a little bit of follow-through. Looking at this chart, I do believe that we are going to go much higher, the $28 level course is an area that has caused some issues, but we have recently peeked through there again, so I think it is only a minor issue.

To the upside, I believe that the market will probably go looking towards the $29 level, and then eventually the $30 level. If we can break above the $30 level then it is likely that the market could go much higher, reaching towards the 50 day EMA over the longer term. I do not like the idea of shorting silver at this point, because quite frankly the US dollar will continue to struggle, and of course precious metals might get a bit of a boost due to the fact that people are becoming a bit nervous in general. After all, if fiat currencies continue to be devalued by central banks, that could be a leading factor for precious metals to go much higher. You can also make a bit of an argument for a bit of an ascending triangle, so all things being equal it does point towards a higher level, but volatility is probably the main thing that you should be looking at here.