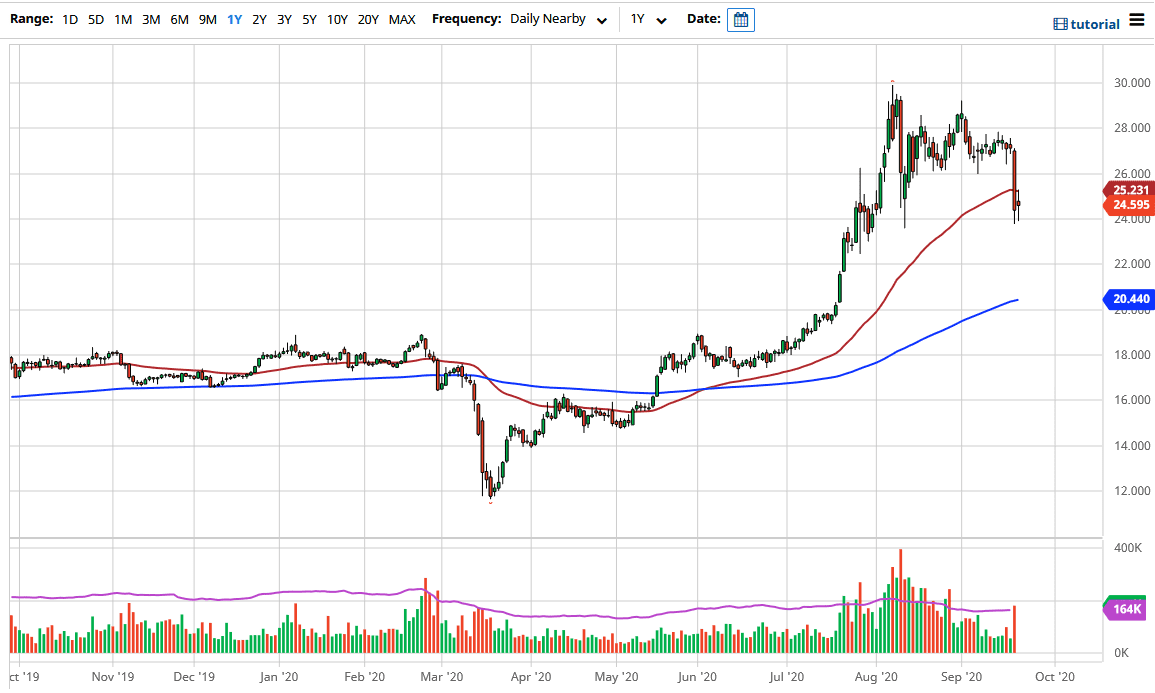

The silver markets went back and forth during a very choppy and miserable day in the pits, as the market could not decide what it wanted to do. With this being the case, and with Jerome Powell’s testimony in front of Congress out of the way, it looks as if the market is still confused. The $24 level underneath offer support, but at this point, I am not overly excited about anything I see on this chart until we get a decisive move.

You will notice that the top of the candlestick touched the 50 day EMA, which is an indicator that some technicians will pay attention to. However, we also pulled back from that level, so it shows that there is no real conviction at the moment. The $24 level offers plenty of support, so that is a good thing for those who are bullish of silver, and I suppose at the end of the day you have to take the fact that the market was somewhat stable instead of falling off of a cliff like it was on Monday as at least a reasonably decent sign of positivity. This also sets up for a bit of a “binary trade”, which is what I will be doing.

What I mean by this phrase is that if we can break above the top of the candlestick on Tuesday, then I think it is very likely we go looking towards the $27 level. In other words, we will wipe out the massive losses for Monday. On the other hand, if we break down below the bottom of the candlestick then it is very possible, we continue to fall. I am not a big seller of silver right here, and I do believe that there is plenty of support underneath on longer-term charts that could come into play if we do break down. That would almost certainly be near the $20 level, but possibly at the 200 day EMA which is sitting just above there. If the market falls, I will simply wait for some type of daily candlestick that gives me some type of sign of bullish pressure that I can take advantage of. Otherwise, I will be flat and, on the sidelines, simply analyzing it on a day by day basis. Silver can be extraordinarily dangerous, so you do need to be very cautious about putting a bunch of money to work in this market.