The silver markets have initially rallied during the trading session on Friday but gave back the gains in order to form a less than impressive candlestick. Ultimately, this ended up being a sign of weakness, but I also recognize that there is a massive amount of support just below. Keep in mind that the silver market is going to continue to be very noisy, as it typically is. After all, silver is much thinner than the gold market.

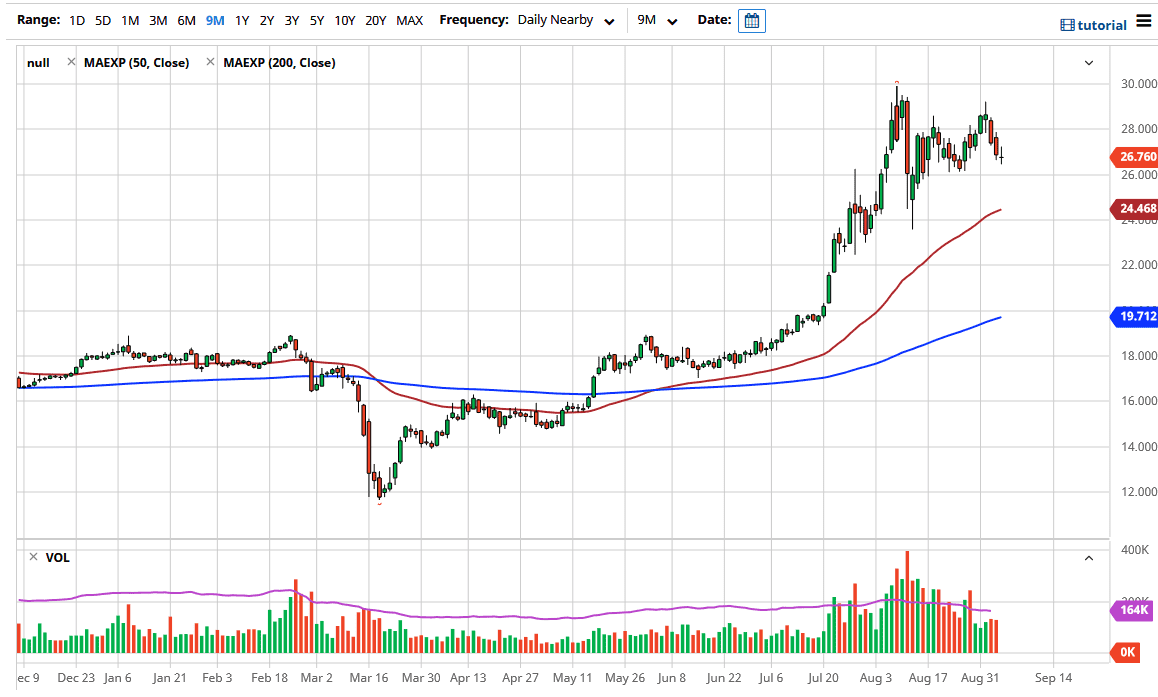

The $26 level underneath should be massive support, so I think it is only a matter of time before buyers would come back into this market and push higher. Even below there I think the 50 day EMA comes into the picture near the $24.50 level, and that the $24 level offers support. I do not have a scenario in which I’m willing to sell this market anytime soon, although you should pay attention to the US dollar because if it strengthens in general that could cause plenty of resistance in this market as we continue to trade almost solely based upon the greenback and what is going on with that.

The shape of the candle does suggest an inverted hammer, so if we were to turn around a break above the top of the candle, then the market will go looking towards the $29 level. Breaking above there would then open up the move towards the $30 level, which is a large, round, psychologically significant figure. Furthermore, if you look at the market it does not take a whole lot of imagination to suggest that perhaps we are in the bit of an up-trending channel, so that could also come into play.

The Federal Reserve continues to loosen monetary policy so in theory that should continue to drive precious metals higher. Beyond the Federal Reserve, there are plenty of central banks around the world that are willing to do the same, meaning that “hard assets” such as precious metals should continue to be attractive over the longer term. At this point, we are still very much in an uptrend, despite the fact that the last couple of days have been negative and therefore you should be keeping an eye on any signs of a reversal. Another thing that you can watch as the US Dollar Index, so you can be aware of the fact that if the US dollar starts selling off again, it could give you a bit of a “heads up” as to what will happen.