The silver markets have rallied a bit during the trading session on Monday as traders came back to work from the weekend. Ultimately, this is a market that should continue to go looking towards the $20 level above, which is a large, round, psychologically significant figure, and an area where we have seen selling in the past. Having said that, this is going to continue to be a very noisy market because silver typically is. Beyond that, this is a market that is highly driven by the US dollar in general, so if we do see the greenback strengthen quite a bit, it could be very negative for silver.

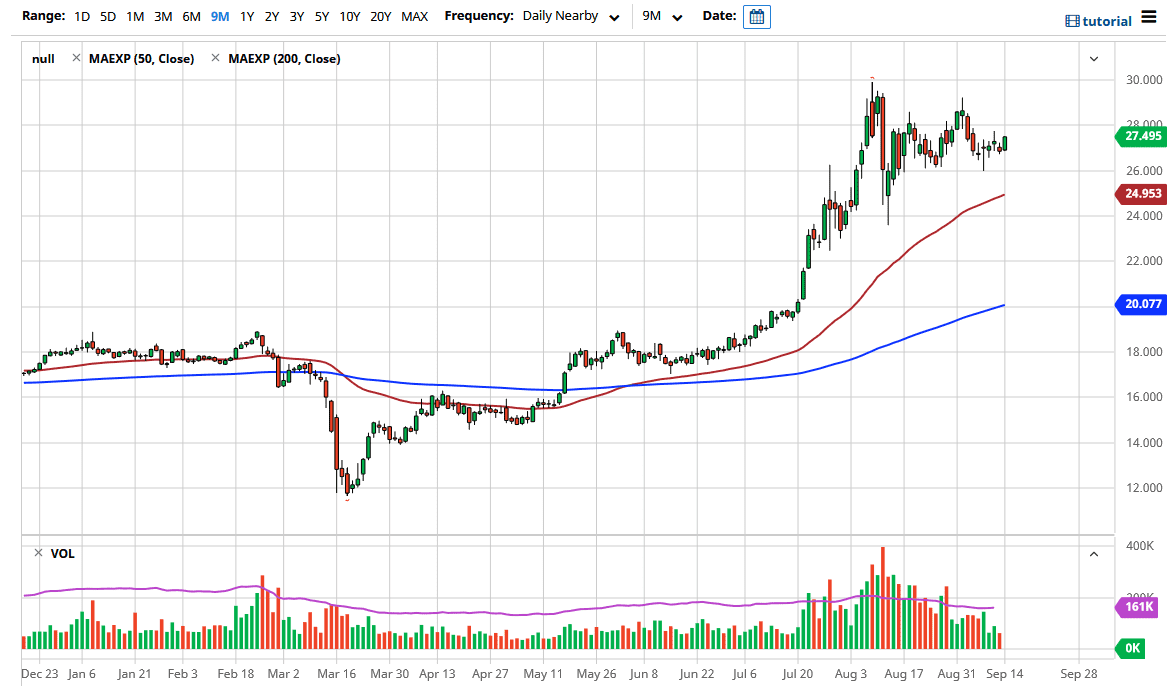

On the other hand, if the US dollar loses value rather significantly, the silver markets will probably take off significantly due to the fact that it is priced in US dollars and quite often traders will look for gold and silver to protect wealth when fiat currencies lose strength. Looking at the longer-term chart, you can make an argument for a bit of an ascending triangle, or perhaps even an uptrend channel. Underneath, the $26 level should be rather supportive, just as the $25 level will be. Furthermore, just below the $25 level we have the 50 day EMA which is an indicator that a lot of longer-term traders will pay attention to.

The money candlestick is the first one that had any type of link to the real body, so that suggests that perhaps we have more upward pressure than down as well, as the previous five candlesticks had very short bodies. If we can break above the $20 level, it is likely that we will see markets try to go towards the $29 level, and then possibly even the $30 level which I think is the “ceiling” in the market. Clearing that area opens up the possibility of a move that would just be starting and could go much higher over the longer term. Pullbacks at this point in time should be thought of as potential buying opportunities, even though you may not want to jump in and start buying immediately. You need to see a supportive daily candlestick on pullbacks in order to add to a position or open up one. Remember, silver is extraordinarily volatile, and therefore you should be very cautious about jumping in. Position sizing of course is also very crucial.