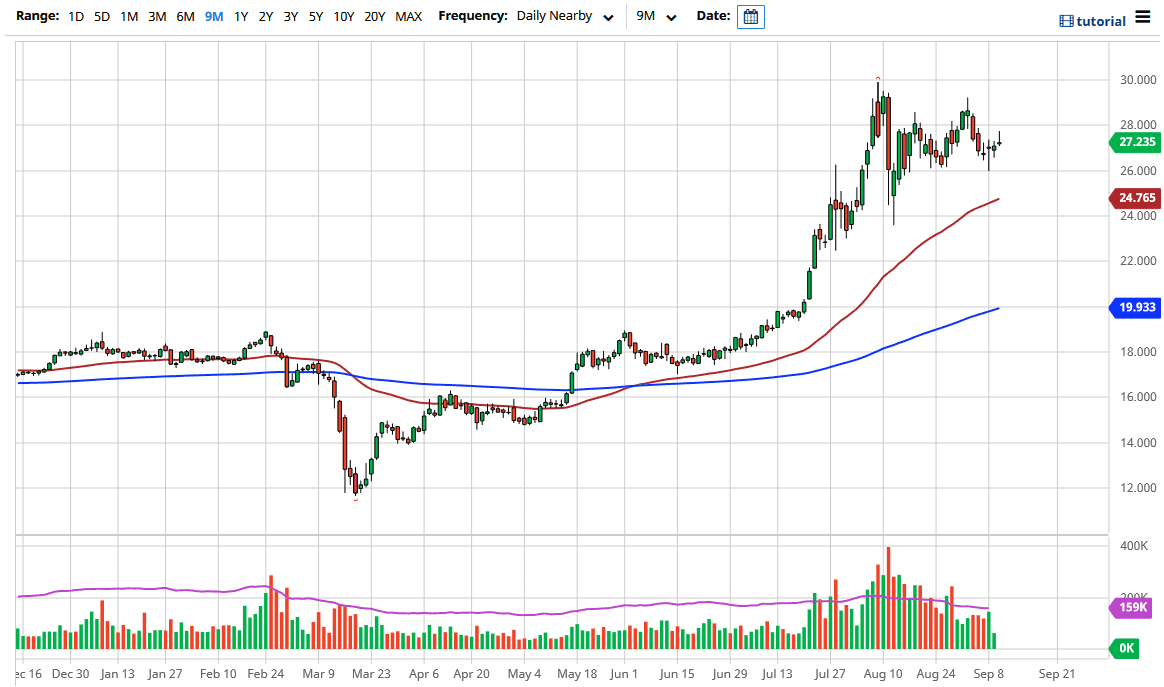

Silver markets initially looked very good during the trading session on Thursday, but the usual nonsense between the EU and the UK started to pick up during the day, thereby driving people to look for some type of safety, which silver is one of the last places they will go to. As the US dollar rose against the British pound, it did put a significant amount of pressure on the metals markets. That being said, it does not necessarily change anything other than it shows you just how volatile these markets are probably going to be for the month of September.

With all that being said, I do believe that it is only a matter of time before the markets make another attempt towards the $20 level, but I also recognize that we have formed a hammer, followed by a candlestick that is kind of like a hammer, followed by a shooting star. This suggests to me through experience that we are more than likely going to bounce around in somewhat sideways action. That would make a certain amount of sense, because after all this market has been doing exactly that for some time. We had rallied quite significantly due to the Federal Reserve looking to support the market again, but questions then remain whether or not there will be industrial demand for silver if the economy is not performing very well? I would suggest that there will not be, and it is very likely that we will continue to see a lot of concern when it comes to the demand.

On the other hand, the main driver of this is probably going to be the US dollar. Pay attention to the FX markets, because of the US dollar is gaining, then that will typically be negative for silver. However, if the US dollar is falling and it is more of a “risk on” type of scenario, although silver is not necessarily a risk type of market, the reality is that an expanding economy needs more of it, so it is almost like a secondary play on that scenario. All things being equal, it looks as if the $26 level underneath is significant support, while the $28 level above is short-term resistance it is also backed up by the $29 level. We have been in an uptrend, and now we are simply trying to digest