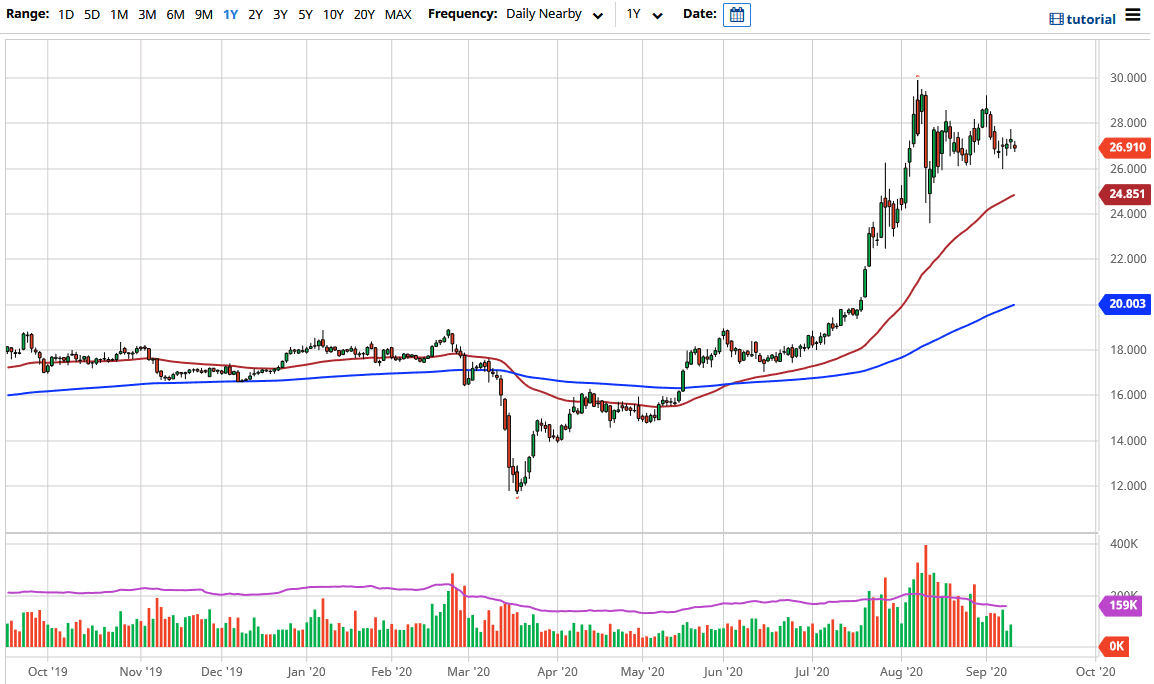

Silver markets have gone back and forth during the trading session on Friday, as we continue to see a lot of noise in equity markets overall. If we can drift a little bit lower from here, I anticipate that there should be plenty of buyers, especially as we get close to the $26 level. However, it is worth noting that the US dollar seems to be strengthening a bit against certain currencies, and that can cause some issues. On the other hand, if we turn around and rally towards the $28 level, it is likely that we will be finding resistance based upon the previous action. If we can break above the $28 level, then we are free to go a bit higher.

All things being equal, the market looks likely to continue to see a lot of volatility, especially as the market has been chopping quite a bit but I do think that the overall uptrend is still very much intact, and we should be paying attention to that. Even if we break down below the $26 level, I believe that we will more than likely find plenty of support at the 50 day EMA which is closer to the $25 level. Because of this, I think that it is worth paying attention to as well due to the 50 day EMA and the psychological importance. With that being the case, it is very likely that we are going to see a lot of volatility going forward as there are concerns about demand when it comes to silver. However, central banks around the world continue to loosen monetary policy, and that’s something that is worth paying attention to. As long as they are going to do that, it will drive up demand for hard assets such as silver, so it is worth paying attention to.

If we can break above the $28 level, we are very likely to go towards the $29 level above, where we have seen some selling pressure and then after that we could go looking towards the $30 level. That is a barrier that is major from a longer-term standpoint, so clearing that would almost certainly kick off another leg higher and impulsivity to the markets. I have no interest in selling silver at the moment but if we were to break down below the $24 level, I would have to think that would be very negative.