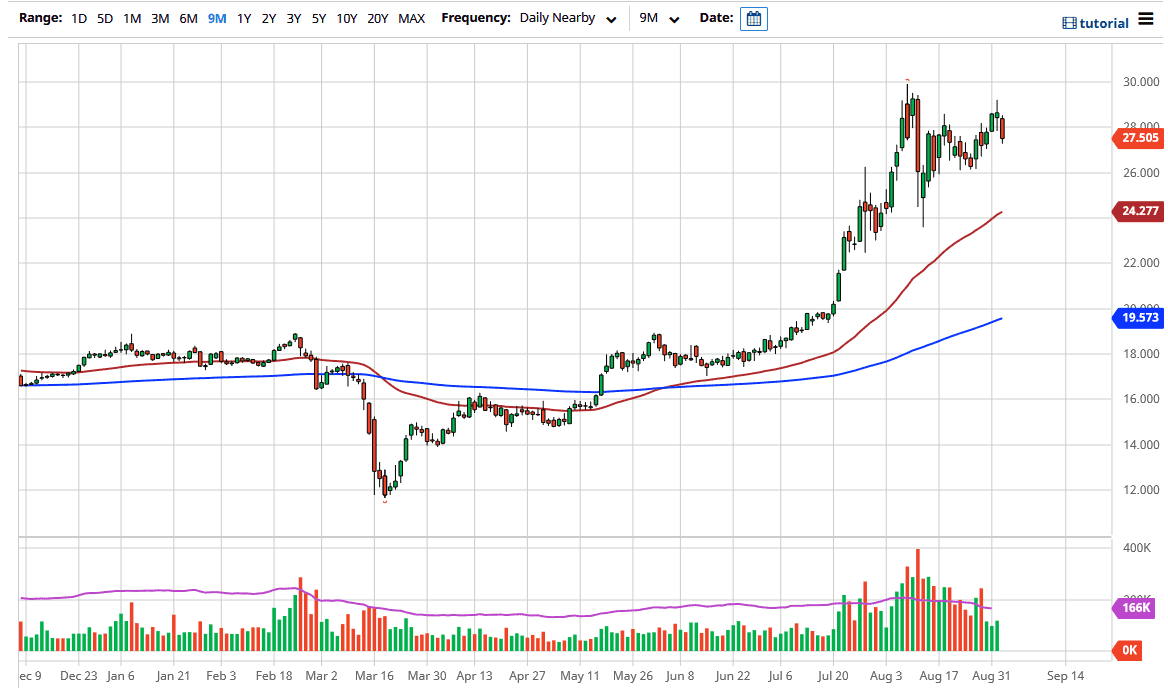

The silver market has broken down significantly during the trading session, slicing through the $28 level. By doing so, the market has reached towards the $27.50 level, an area that is short-term support and resistance level, but I do not know that it is a big enough reason to go long based upon that “midcentury level.” Looking at this chart, I think that we are likely to continue to pay more attention to the US dollar than anything else. After all, the silver market is very sensitive to the value of the US dollar, as the commodity is priced in the greenback.

To the downside, the $26 level should offer quite a bit of support, as it had recently offered support as well. Ultimately, the $26 level leads into the massive support at the $25 level. The 50 day EMA is also reaching towards the $25 level, so think at this point in time there would be a lot of buyers looking to pick up value. This will be especially true if the US dollar gets hammered. Keep in mind that Friday is a significantly important day as it is the Non-Farm Payroll announcement and that will show quite a bit of volatility in the greenback itself.

To the upside, the $29 level begins significant resistance that extends all the way to the $30 level. If we were to be able to break above the $30 level it is likely that it would lead to a bigger move much higher. A breakout above that level could send this market much higher, perhaps even as high as the $50 range as we have seen multiple times in the past. Having said that, we have been very bullish for some time, so it may take a bit of digesting to continue the uptrend. After all, when you look at this chart you can see that we shot straight up in the air, and now we are simply just grinding back and forth. I like the idea of buying dips and taking advantage of value when it occurs, but I think you also should be very cautious and realize that the volatility is likely to be very strong, and the choppiness will be a major issue going forward. Keep your position size relatively small to protect your account.