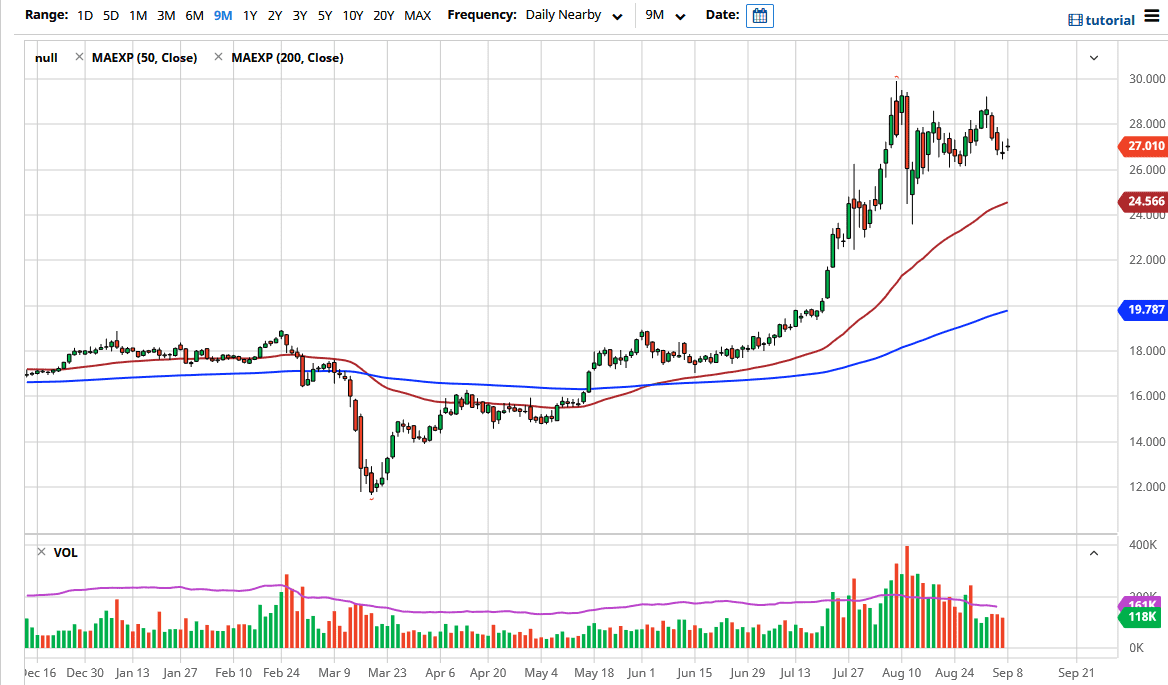

The silver markets gapped higher to kick off the Monday session but then simply danced around the $27 level. I would not read too much into it though, because it was electronic trading and some of the biggest trading firms and banks were not even going to be involved in the market. With this, what you should be paying attention to is the fact that we have been in an uptrend for some time, and we have been grinding slightly higher. “Grinding” is probably the best way to describe the overall uptrend.

The $26 level underneath should be supportive, just as the 50 day EMA should be which is currently at the $24.54 level. As we continue to grind higher, the 50 day EMA will eventually overtake the $25 level, allowing it to become a bit of a “floor in the market.” It does make sense that silver continues to gain, especially if the US dollar can continue to lose value as it has over the last several weeks. Pay attention to the US Dollar Index, as it can give you an idea as to what the US dollar is going to do in general, which has a drastic influence on what happens with the silver market, as well as gold and platinum.

The silver market did not do a lot during the day, but keep in mind that there is not much in the way of volume. Silver will have a certain amount of psychological resistance at the $20 level, but I think we continue to grind towards the $29 level. After that, it will be a massive fight to get above the $30 level, which is a major level from multiple breakouts in the past. That breakout quite often will push the market as high as close to the $50 level, which has happened a couple of times in the past. This is where the runaway attitude of silver really shines, so expect getting above the $30 level to be very difficult. That does not mean it cannot happen, it just means that it will not suddenly happen without some type of catalyst. Regardless, we are most certainly in an uptrend so buying dips and pullback should continue to be the way you should look to trade this market because shorting is all but impossible at this point in time.