The NASDAQ Composite will be watched by global investors and speculators carefully today. Before going into the long holiday weekend in the US the index roiled and saw swift and violent selloffs. Early yesterday, the NASDAQ Composite showed signed of potentially producing positive momentum via the future markets. However, the early optimism was abruptly shaken as the NASDAQ Composite again began to experience selling. A loss of over 4% was experienced in yesterday’s trading and over the past month, the NASDAQ Composite has actually turned in a minus -1.48% change.

However, before traders jump off of what they may perceive as a sinking ship, it should be taken into account as one and half percent drop in value over a month of trading for a major equity index is actually not a grave and dangerous decline. Stock markets go up and they go down, but the NASDAQ Composite’s price action has not made it a bear market quite yet. Speculators who are thinking about selling the index early today may want to wait until they see some price momentum emerge. And they should also note that early calls via the futures markets indicate a positive move upwards actually.

The NASDAQ Composite must be traded carefully today and tomorrow. Risk management should be an integral part of a trading position. A proclamation that the bull market in US equities is dead could prove to be foolhardy. The NASDAQ Composite remains relatively close to its all-time highs. Yes, its selloff the past three trading sessions have been violent and if you have been on the wrong side of the market without stop losses you have likely seen your account get hit hard.

Trading the NASDAQ Composite today is a decision that speculators should think about carefully. Dangerous and strong moves downward have been evident and the inclination to wager on a sudden rebound in value could prove costly if the market continues to see a large amount of selling. Traders who do decide to wager on the NASDAQ Composite today may want to challenge the short term trend and look for a reversal higher. However, these same traders looking for bullish momentum to emerge should also be ready with cautious stop-loss ratios entered.

NASDAQ Composite Index Short Term Outlook:

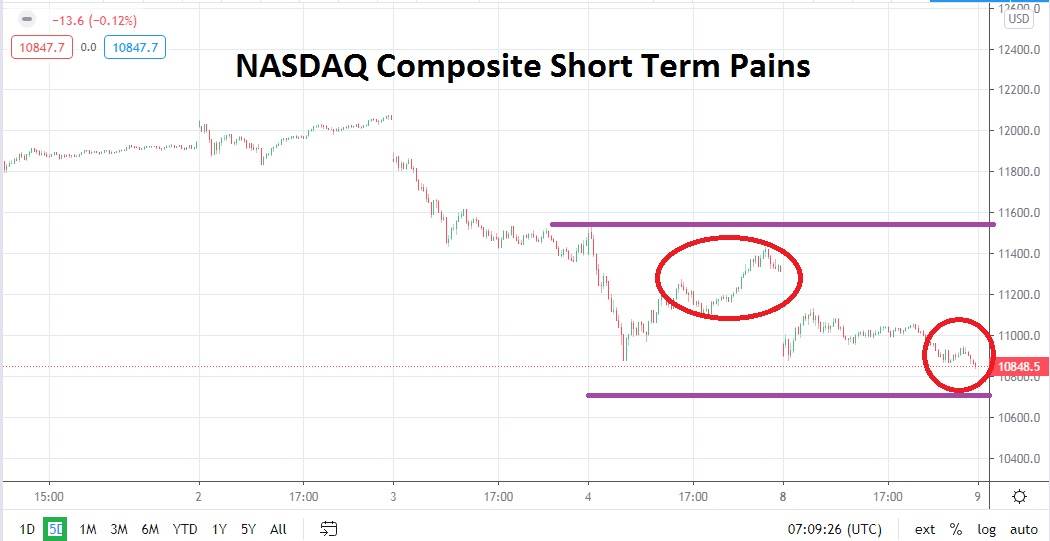

Current Resistance: 11200.0

Current Support: 10700.0

High Target: 11400.0

Low Target: 10600.0