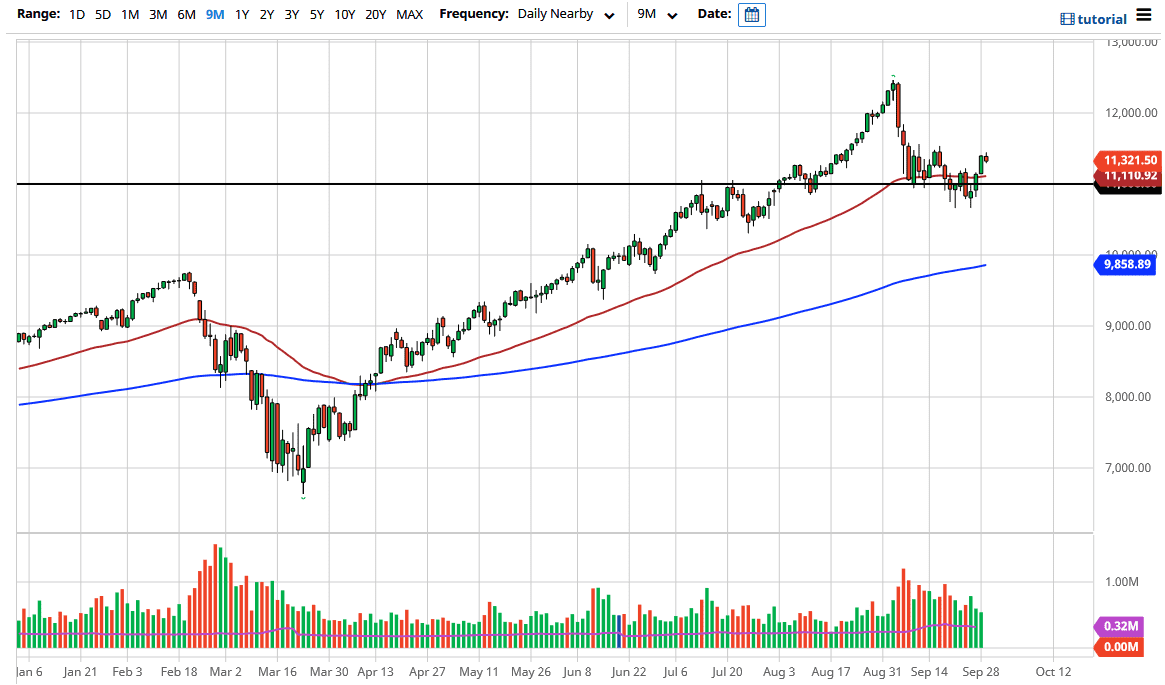

The NASDAQ 100 initially tried to rally during the trading session on Tuesday, only to pull back from the 11,450 level. That being said, it looks as if the market could pull back a little bit further, but I also anticipate that there is a lot of support underneath. The 50 day EMA is currently flat and just above the 11,000 level, an area that is obvious support from a psychological standpoint. After all, traders like large, round, psychologically significant numbers, and use them to enter and exit the markets.

Another thing that people will be paying attention to is the value of the US dollar, and even though the greenback lost some value during the trading session on Tuesday, stocks could not get a boost. That is particularly concerning for those who are bullish of the stock market long term, so I think what we are seeing here is a bit of a rounding bottom be informed, and therefore I think that short-term pullbacks will be looked at as potential value building opportunities, so if we were to break down below the lows of last week, that would be a very negative sign in send this market looking down towards the 10,500 level, and then perhaps even down to the 10,000 level after that.

The 200 day EMA sitting just below there obviously offers a lot of support as well, but I think that we get down towards that area. It looks to me as if we are trying to form some type of rounding bottom pattern, which suggests that we are going to have a bit of a process. Furthermore, we have the presidential elections in a few short weeks, and with the debate last night, we could see a little bit of volatility due to that as well.

A break above the highs near the 11,550 could open up the market towards the 12,000 level, and then perhaps even towards the 12,500 level. I would like to see a little bit more pressure buildup first in order to make it more of a sustainable move, so ultimately I do think that value hunters will eventually push this market higher, but you should also keep in mind that headlines will be coming fast and furious over the next couple of weeks.