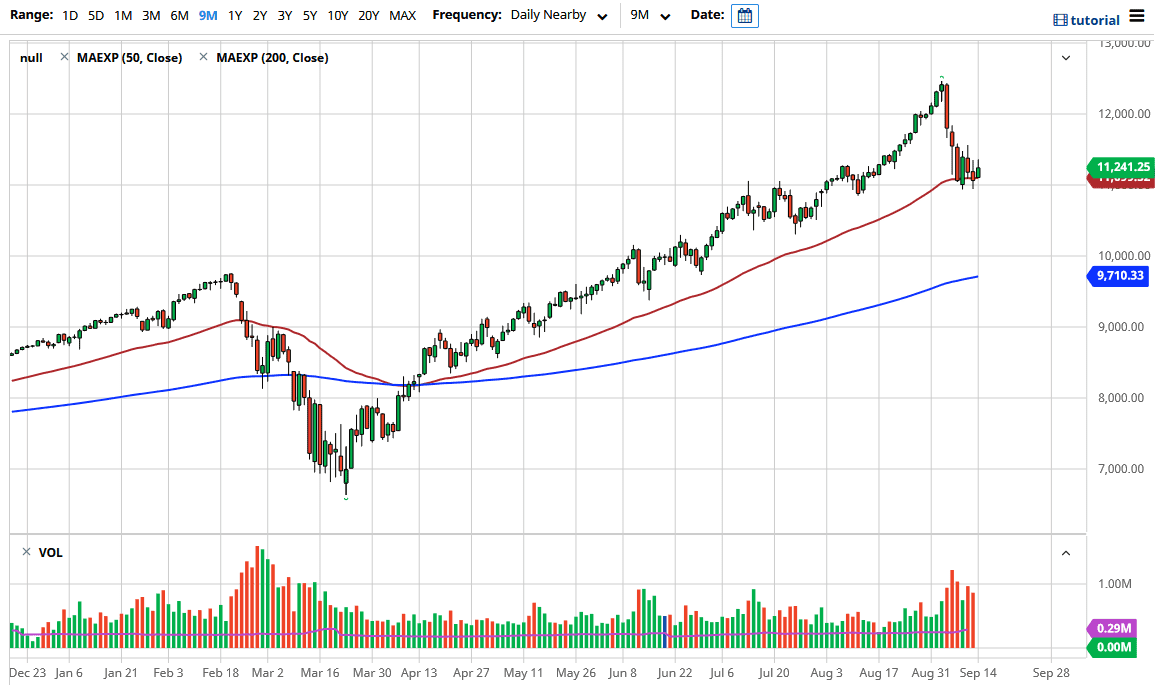

The NASDAQ 100 has tried to rally during the trading session on Monday but has given back quite a bit of the gains. Ultimately, the market looks as if it is trying to test the 11,000 level underneath for support. This is a large, round, psychologically significant figure, and an area where there will be a lot of interest. This is an area that has been important previously, so it will be interesting to see how it behaves now.

If we were to break down below there, that could open up a rather significant move back down to the 10,000 level, which the 200 day EMA is racing towards. That is an area that will catch a lot of attention due to the fact that it is a large, round, psychologically significant figure, and an area that previously had seen a lot of resistance. If you look at the recent price action, you can make an argument for a descending triangle, but it is a little early to get overly excited about that. This is just as a break above the 11,400 level would negate everything and send this market to the upside.

Looking at this chart, it is likely that we would see a lot of volatility, but we have been in an uptrend for some time, so if we do break down it might be a sudden snap to the market. If that happens, then it is likely that this could be a bit of a “runaway train” as the NASDAQ 100 tends to panic all at once. At this point, the market is hanging on by a thread, so it will be interesting to see how this plays out. Beyond here, just a handful of stocks have been overbought for some time, and that has had a major influence on how this market has behaved.

The one thing that the bullish traders out there should be looking for is some type of sideways action because at this point the market needs to stabilize and people need to be much more comfortable in order to have a longer-term uptrend continue. A sudden “V-shaped recovery” is not good, because it would only lead to an overextension of the trend yet again. This is what we need to see in order for this market to continue to move higher in a healthy manner. The last thing we need is a sudden boost of straight up in the air trading.