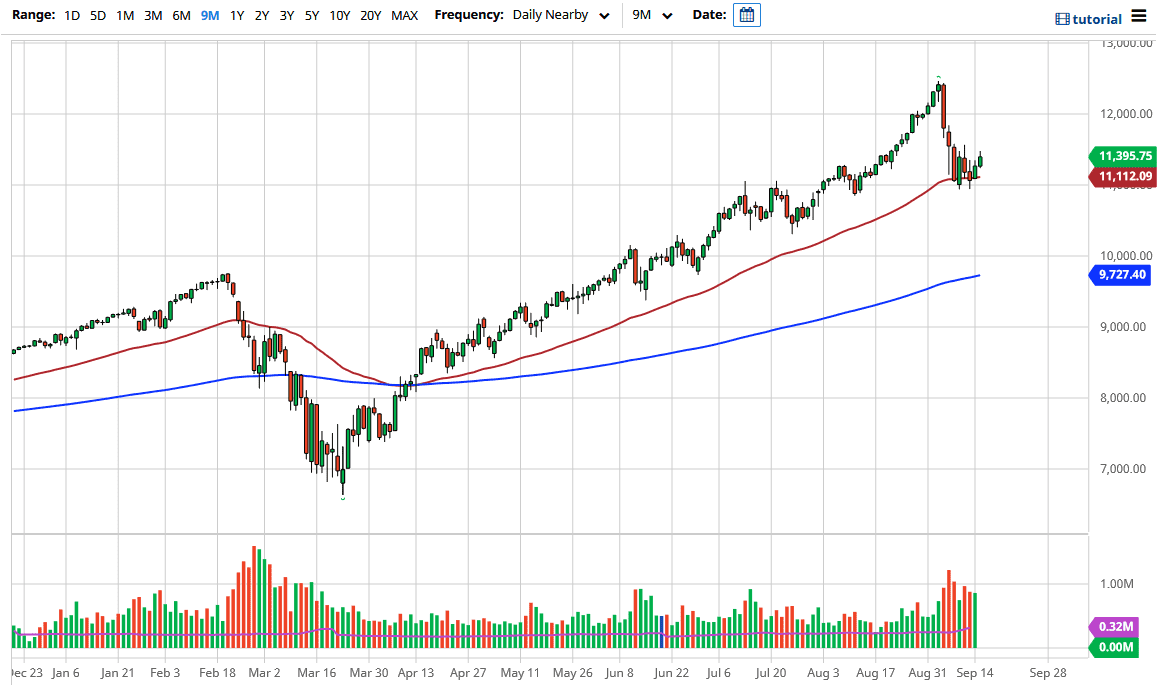

The NASDAQ 100 has rallied a bit during the trading session on Tuesday, slamming into the 11,500 level. That being said, it is worth noting that as we closed out the day it seemed that more sellers were showing up. It looks as if the 11,500 level is going to cause some issues, so I think at this point in time it is likely that we go back and forth, at least until we get some type of reason to get bullish. For what it is worth, it does seem like the 50 day EMA is offering support though, so that is most certainly something to pay attention to.

Beyond the 50 day EMA, we also have the 11,000 level which is a large, round, psychologically significant figure. That is something worth paying attention to, not only because large funds tend to jump in at big figures, but we should also keep in mind that a lot of options are based around these big figures as well, so that is going to have an effect, especially this week as it is quad witching week, meaning that for different options will be expiring, making Friday afternoon an absolute disaster just waiting to happen. With that being the case, we may have a very choppy week going forward and the fact that there are a lot of concerns when it comes to the global economy certainly is not going to help either. In fact, a lot of people are starting to worry about growth and possible recessionary headwinds. If that is the case, certain assets will struggle, and the NASDAQ 100 will more than likely be one of them.

On the other hand, if we were to break above the 11,500 level, we could see a continuation of the uptrend, but the way that the market closed suggests to me that we are ready to do so. There was the attempted pump of the market by the President early in the day suggesting that we were very close to a vaccine, but the thing about Wall Street is those types of tricks only work about the first 20 times or so. It appears that we are starting to see the efficacy of the vaccine bounce fading, and at this point, we will need to find some type of new narration to send the market higher. I think at this point we are simply going to grind back and forth but if we were to give up 11,000 underneath, this market will probably fall rather quickly.