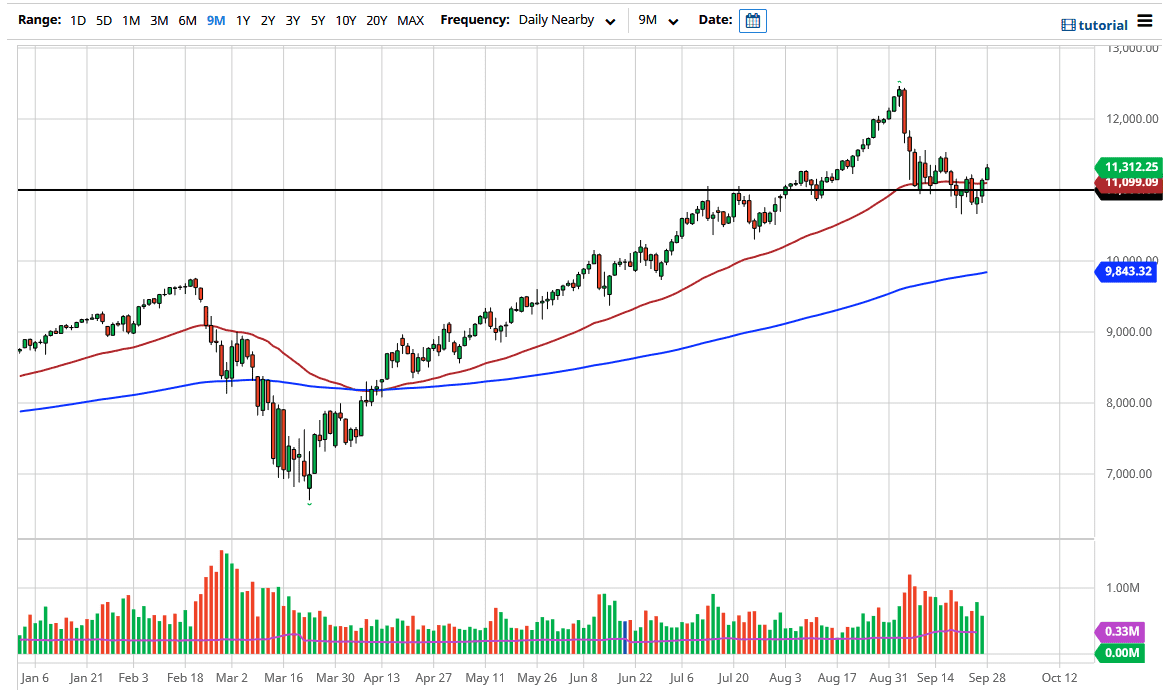

The NASDAQ 100 has rallied a bit during the trading session on Monday as we are above the 50 day EMA. That of course is a technical victory for the buyers, but we still have a significant resistance just above at the 11,550 level. If we can break above there, then I think a lot of buyers will continue to jump into this market in order to chase momentum. It should be noted that the 50 day EMA is essentially flat, so that of course suggests that we are going to consolidate as well.

I think at this point in time we are going to continue seeing a lot of back-and-forth trading for the rest of the week, but it certainly looks as if we are trying to find some type of base in which to rally going forward. The market has been grinding lower for some time, so I do think that there are a lot of opportunities for sellers jump in and cause issues but when you look at the longer-term chart we are most certainly in an uptrend. Besides, the NASDAQ 100 is heavily weighted to just a handful of stocks, so essentially it is designed to go up over the longer term regardless of what happens.

I think if we break down below the candlestick from Thursday, then it opens up a potential move down to the 10,500 level, possibly even the 10,000 level after that. The 200 day EMA is sitting just below there as well, so it would make quite a bit of sense that we have potentially significant and massive support in this area. The market has been very choppy over the last several sessions, so I think it makes quite a bit of sense that we would see a lot of volatility in back and forth in this general vicinity. Having said that, I do think that the path of least going to be higher, but we also see a lot of influence from the US dollar, so if the US dollar starts to strengthen that may continue to cause even more noise and choppy behavior. If you pay attention to Microsoft, Amazon, Alphabet, Facebook, and Netflix, you can get an idea as to what this index is going to do. Expect choppy behavior between now and the election regardless.