The US currency received support from the US Federal Reserve’s announcement of its monetary policy yesterday, despite its indication that US interest rates should be maintained at their historically low level for a longer period than the markets had expected. Therefore, the price of an ounce of gold fell to the $1937 at the beginning of Thursday’s trading. Before the yellow metal stabilized around $1950 an ounce at the time of writing. Prior to the bank’s announcement, it was announced that US retail sales would continue to rise during the month of August. However, the pace of growth was much lower than economists ’estimates. The official report said that retail sales rose 0.6% in August after rising by a downwardly revised 0.9% in July. Economists had expected retail sales to increase by 1% compared to the 1.2% jump originally recorded from the previous month.

Then a report released by the National Association of Home Builders showed that US homebuilding confidence jumped to a record high in September. The report said the NAHB/Wells Fargo Housing Market Index rose to a reading of 83 in September from a reading of 78 in August. Meanwhile, a report released by the Commerce Department showed that US business inventories rose 0.1% in July after falling 1.1% in June.

The economic hardships caused by the COVID-19 pandemic have forced the Federal Reserve to keep interest rates unchanged and the indicated rates are likely to remain at levels near zero for years to come. The bank announced its widely expected decision to keep the federal funds rate target range from 0 to 0.25%. The bank said it expects interest rates to remain at current levels until labour market conditions reach levels consistent with the employment cap. Inflation has risen to 2 percent and is on its way to be moderately above 2 percent for some time.

The economic outlook presented alongside the announcement indicates that most Fed officials expect interest rates to remain unchanged until at least 2023. The US Central Bank stressed its readiness to adjust the monetary policy stance as appropriate if risks appear that may impede the achievement of its objectives. In its assessment of the economy, the Fed noted that activity and employment have picked up in recent months, but they are still well below their levels at the beginning of the year.

The Fed also said that weak demand and significantly lower oil prices continue to put pressure on consumer price inflation. The bank statement referred to the bank's recent shift towards “average inflation targeting,” saying that the central bank would aim to moderate inflation above 2% for some time with inflation averaging 2% over time. Fed officials forecast that consumer price inflation will remain below 2.0 percent until at least 2023.

The bank's latest estimate points to a 3.7% contraction in GDP in 2020, reflecting an improvement from the 6.5% downside forecast in June. Nevertheless, the Federal Reserve revised its estimates of GDP growth in 2021 and 2022 to 4.0% and 3.0%, respectively. GDP growth in 2023 was projected at 2.5 percent.

The US central bank reiterated its commitment to use its full range of tools to support the US economy at this difficult time.

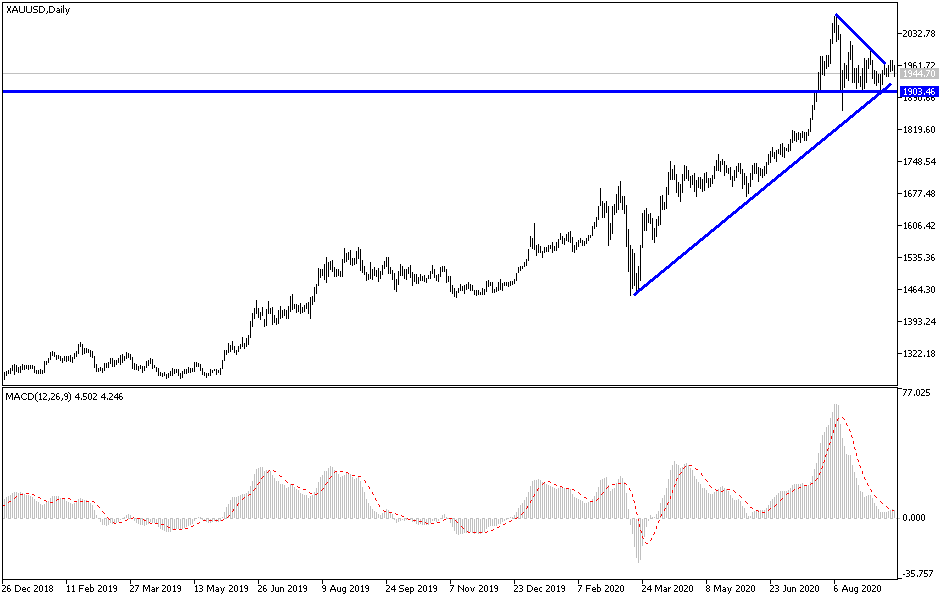

According to the technical analysis of gold: Recent decline in gold prices is an opportunity to think of new buying levels, and the most appropriate ones will currently be 1933, 1920 and 1900, respectively. The current decline is temporary, and the general trend is still up, and the factors for the yellow metal's gain are still in place and increasing. Therefore, I still prefer to buy gold from every lower level. On the upside, gold bulls are still fully convinced to move the metal to the historic peak at $2000 again as soon as possible. Gold will interact today with the monetary policy announcements of both the Central Bank of Japan and the Bank of England, the US economic issues, jobless claims, the Philadelphia industrial index and US housing starts data.