For five trading sessions in a row, gold prices witnessed an upward movement with gains that pushed to $1973 an ounce, its highest level in two weeks. Gold futures contracts reduced a large part of the gains, as the price stabilized around the $1955 an ounce at the time of writing, ahead of this week’s important events. As the US dollar trimmed its losses, it eventually managed to close slightly higher. The dollar has lost ground after a weak start as investors look to the Fed's monetary policy announcement on Wednesday. Silver futures also closed higher at $27.46 an ounce, while copper futures settled at $3.0630 a pound.

The most important event for financial markets and investors this week is the Fed’s monetary policy announcement. The US central bank is widely expected to leave interest rates unchanged, but investors are likely to pay close attention to any amendments to the accompanying statement. In the same circle of interest, the latest central bank economic forecast may attract attention as well and affect investor sentiment, and Governor Jerome Powell's remarks will no longer be of less importance.

In terms of economic news, a report issued by the Federal Reserve Board showed that industrial production growth in the US slowed more than expected in August, with production increasing by only 0.4% compared to expectations of a 1% jump. In July, industrial production rose by an upwardly revised 3.5%. Although production increased for the fourth month in a row, it is still 7.3% below its level before the outbreak in February.

A separate report from the US Labour Department showed another noticeable increase in US import prices in August, as prices jumped more than expected.

Global economic prospects are still facing a state of pessimism considering the continuation of the COVID-19 pandemic. In this regard, the Asian Development Bank said yesterday, in an update of its forecasts, that developing economies in Asia will contract in 2020, the first such contraction in nearly 60 years. An update to the Asian Development Bank forecast estimates that the regional economy will contract by -7% this year, recovering to 6.8% growth in 2021. The regional bank added that conditions may deteriorate further if the Coronavirus pandemic worsens significantly. The update reduces growth estimates for many countries in the region, as coronavirus outbreaks have increased in some countries, such as the Philippines and Indonesia.

The report added that China, where the pandemic began, has already begun to recover and will see its economy grow by 1.8% this year and 7.7% in 2021. The growth of the Chinese economy by 6.1% in 2019 is the slowest pace of growth there in decades. The report also noted that Asia's position as a production base for many medical products, digital devices, and optical equipment helped cushion the trade blow from the epidemic slowdown.

However, the report said that the region's downturn is the worst since the early 1960s.

Commenting on the update, the chief economist at the Asian Development Bank, Yasuyuki Sawada, said, "This has set back efforts to lift hundreds of millions of people in our region out of poverty." Governments in several countries have imposed border controls, closures, and other restrictions to stop the spread of the COVID-19 and prevent further outbreaks. But such measures come at a great economic cost.

To help with compensation, regional governments promised $3.6 trillion, equivalent to about 15% of regional economic activity, in the form of subsidies, loans, and other forms of support for individuals and businesses.

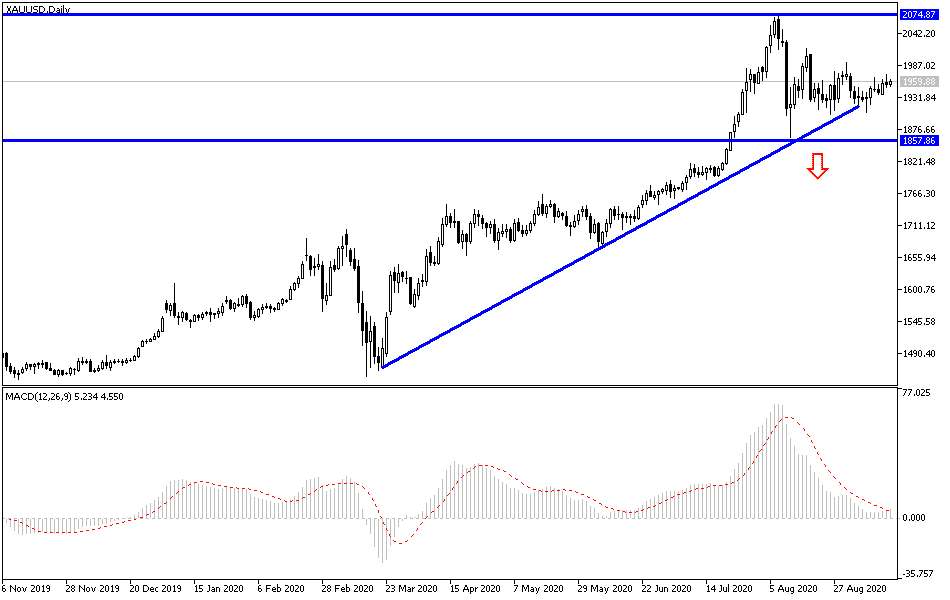

According to the technical analysis of gold: Although gold gains stopped, the general trend is still upward, and as I expected, stability above the $1900 resistance continues to stimulate investors to increase the purchase of the yellow metal. The current most important opportunity for gold is to move towards, and pass the $2000 psychological and historical resistance, especially if the US Central Bank’s decisions came today in support of more pressure on the US dollar. In general, I still prefer to buy gold from every lower level and the closest support levels for gold are currently at 1942, 1930, and 1900, respectively. The yellow metal will interact with the level of global geopolitical tensions and the course of the Coronavirus as the winter season approaches, and there is no final vaccine yet, along with Trump's future in the upcoming presidential elections.