The recent sharp gains in the US currency were a good reason for gold price collapse to the $1883 an ounce during Monday's trading, which is the lowest price for the yellow metal in two months. However, gold quickly rose to $1920 an ounce at the beginning of Tuesday's trading, ahead of the most important event for this week, which is the testimony of Federal Reserve Governor Jerome Powell. The metal price is stable at around $1889 at the time of writing. Gold ignored a preferred safe haven by investors The financial sector was hit hard on Monday after a report alleging that a number of banks - JP Morgan, HSBC, Standard Chartered, Deutsche Bank, and Bank of New York Mellon - continued to profit from illicit dealings with notorious people and criminal networks despite previous warnings from regulators.

The decline in gold prices coincided with the decline in global stocks and the strengthening of the US dollar, amid mounting concerns about an increase in Coronavirus cases in Europe and fears of widespread closure measures. The US dollar gained on-demand as a safe haven as virus fears chased sentiment and weighed on riskier assets such as stocks. Accordingly, the Dollar DXY Index rose to 93.78, and although it declined to 93.68 after that, it increased by more than 0.8% from the previous close.

In the same performance line, silver futures contracts for the month of December ending transactions down by $2.742 at $24.387 an ounce, while copper futures for December settled at $3.0320 a pound.

Financial markets are now looking forward to speeches by Fed Chairman Jerome Powell and Treasury Secretary Stephen Mnuchin. They are scheduled to speak before the House Financial Services Committee on Tuesday. Several members of the Fed, including Charles Evans, James Pollard, John Williams, and Mary Daly, are set to deliver speeches at various events this week as well.

Yesterday European stocks collapsed, leading to a sharp drop in major indices. The UK's FTSE, the German DAX, and the French CAC 40 fell by 3.38%, 4.37%, and 3.74%, respectively. The pan-European Stoxx 600 is down 3.24%. US stock indices were not far behind as the Dow Jones dropped 2.85%, the S&P500 index fell 2.2% and the Nasdaq index fell 1.4%.

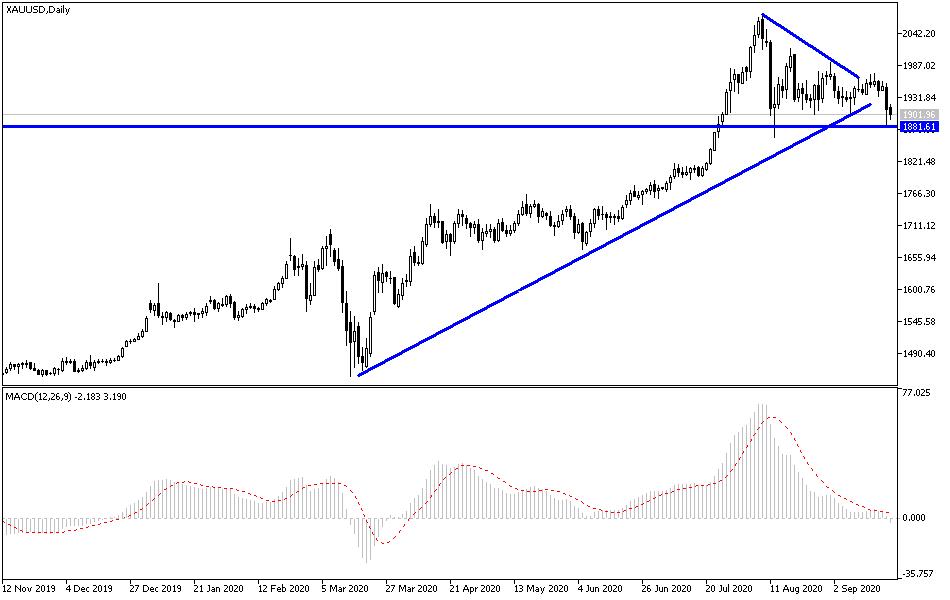

According to the technical analysis of gold: The recent selling operations have pushed the technical indicators to strong oversold areas. As I mentioned before, the decline in the price of gold to the vicinity of 1900 and below will be an opportunity to think of new purchases. And the closest support levels for gold are currently in 1886, 1872, and 1860 dollars, respectively. I still prefer to buy gold from every lower level, as it is the most important traditional safe haven for investors in times of uncertainty, and its gaining factors remain the US/Chinese tensions, the devastating effects of the Coronavirus, a bleak future for Brexit and Trump's future in the upcoming US presidential elections. On the upside, the bulls will reign again to launch towards new record highs if the price of gold returns to the top of the $1945 resistance.

As for today's economic calendar data: There will be important announcements expected from Governors of both the Bank of England and the US Federal Reserve.