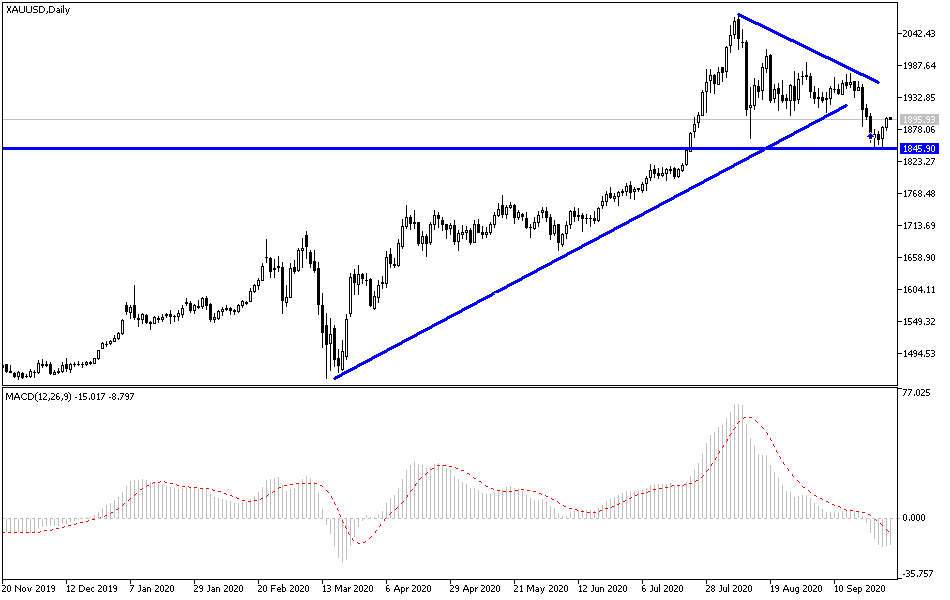

In recent technical analysis of the gold price expectations, we mentioned that the yellow metal has the opportunity to move towards $1900 an ounce, a level that may provoke more buying and thus pave the way for a retest of the standard resistance levels. We emphasized that the factors of gold's gains are still in place, and the recent correction was supported by profit-taking selling and a sharp recovery in the US dollar. The price of an ounce of gold stabilized around $1895 per ounce at the beginning of trading today, Wednesday, ahead of economic data, and important events affecting investor sentiment.

Gold prices rose on Tuesday, extending gains from the previous session, as the dollar continued to show weakness.

Weak stock markets amid growing concerns about an increase in coronavirus cases around the world, uncertainty about Brexit, and caution ahead of the presidential debate between President Donald Trump and Democratic candidate Joe Biden, making global stock markets weak. Markets are in a state of wait and see as Trump and Biden are scheduled to meet tonight in Cleveland in the first of three debates that could destabilize the race for the White House.

Markets have also been reacting to updates on negotiations on a new coronavirus bailout and news on the Brexit front. According to the performance of gold, silver futures closed higher at $24,445 an ounce, while December copper futures settled at $2,9900 a pound.

According to reports, the Democrats unveiled their latest relief package Monday night before resuming negotiations with Treasury Secretary Stephen Mnuchin. For her part, House Speaker Nancy Pelosi said in a statement, "Democrats fulfill our promise to waive the updated bill, which is necessary to address the immediate health and economic crisis facing working families in America now."

On the Brexit front, the European Union and Britain indicated that a post-Brexit deal remains elusive with the resumption of negotiations on implementing the withdrawal agreement. On the front of the Covid-19 outbreak, the global death toll from the pandemic rose to more than a million as of Monday night, as United Nations Secretary-General Antonio Guterres described it as a "mind-numbing figure."

He said it was crucial for the international community to learn from the mistakes made in the first 10 months of the pandemic. Separately, Anthony S. Fauci, a leading infectious disease expert in the United States, described Florida's entire reopening of bars and restaurants as "extremely worrying," and warned that it would spark more outbreaks of the coronavirus.

According to the technical analysis of gold: The recent upward momentum of the gold price is still in need of more strength to support more purchases of gold, and if the bulls succeeded in stabilizing the price of the yellow metal above the resistance of $ 1900, the next resistance levels for gold maybe 1918, 1932 and 1955, respectively. In return, bears will regain control over the performance, as is the case since the middle of this month's trading, if the gold price moves towards and below the support level at $ 1847 again.

The gold path will be affected by the extent of fears of the outbreak of the Corona epidemic and the return of global closure restrictions to contain the disease, the extent of the failure or success of the Brexit negotiation round, and the market reaction from the debate between the US presidential election candidates. Not to mention, the extend of investors’ risk appetite. Then the reaction from the announcement of a batch of important global economic data today.