In the last three trading sessions last week, gold prices retreated to $1916 an ounce, after a strong attempt by the bulls to push the price towards the level of $2000 psychological resistance at the beginning of the week's trading. Losses were supported by selling as the US dollar recovered, and investor risk appetite improved. The price of gold stabilized around $1937 per ounce at the beginning of this week's trading, as factors of gains still exist, global geopolitical tensions still exist. The human and economic losses from the COVID-19 outbreak are still continuing with the winter season approaching without a vaccine that eliminates the deadly disease, the plight of the global economy will increase, which in the first wave of the outbreak was exposed to the largest recession since World War II.

The trillion stimulus plans by global central banks and governments have not stopped and will not stop for as long as the virus is present. Contributing to gold's losses, the DXY US dollar index recovered from its lowest level in two years. This caused gold futures to decline by 2.1% last week. In the same performance, silver futures contracts closed lower at $26.71 an ounce, while copper futures settled at $3.0620 a pound.

In terms of economic data, data from the US Labour Department showed a significant increase in US employment during the month of August, although the pace of job growth continued to slow from the record high recorded in June. According to the data results, employment in the non-agricultural sector increased by 1.371 million jobs in August, after increasing by 1.734 million jobs, which were revised downward in July and increased by 4.781 million jobs in June. Economists had expected employment to jump by about 1,400 million jobs, compared to the addition of the 1.763 million jobs originally reported for the previous month.

The strong job growth in August was partly due to the employment of 238,000 temporary workers in the 2020 census, which contributed to a significant increase in government employment. The US unemployment rate decreased to 8.4% in August from 10.2% in July. Economists had expected the unemployment rate to drop to 9.8%. The unemployment rate continued to fall from a post-WWII record high of 13.5% in April but remained well above the 50-year low of 3.5% seen late last year.

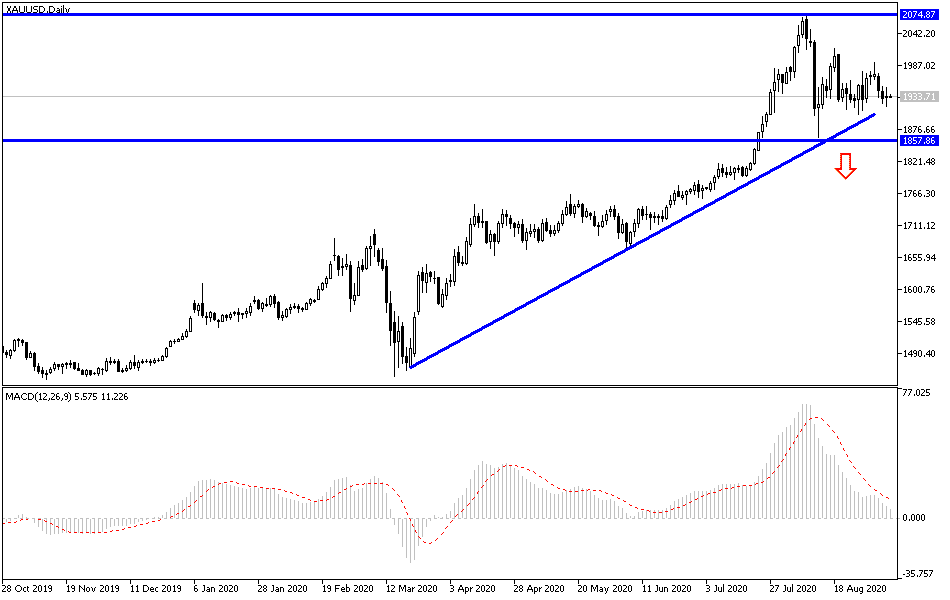

According to the technical analysis of gold: Despite the bears' attempts to control the price of gold, the long-term general trend is still bullish if the price of gold is stable above the resistance at $1900 an ounce. The bulls might gain control if prices moved towards the resistance levels at 1948, 1965, and 1990 respectively. We still prefer to buy gold from every lower level and the most appropriate buying areas are currently at the support levels 1920, 1890, and 1865, respectively. It must be taken into consideration that the Corona pandemic has caused a change in the monetary policy numbers of global central banks led by the US Federal Reserve, which is a historic measure that did not happen during the global financial crisis, which confirms that the crisis is deep and that other global central banks may move on the same path alongside the adoption of negative interest rates, which will be strong support for future gold prices.

Markets are not expecting any important economic releases today, and the US bank holiday today may have a direct impact on market liquidity.