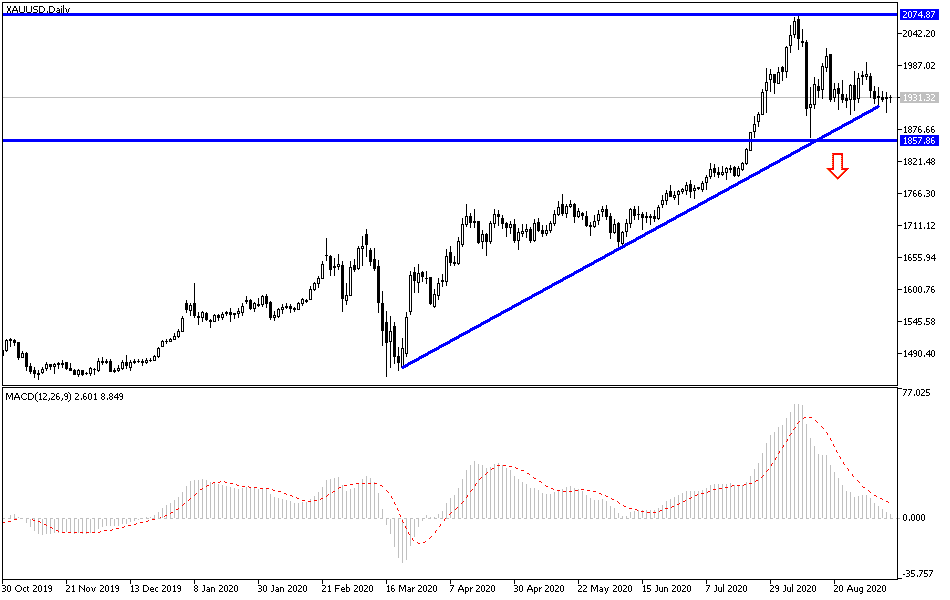

We indicated from last week that the opportunity for gold prices to drop to $1908 an ounce is best suited to buy in light of the USD recovery. Indeed, the price fell to what we expected, from which the bulls bounced the price gold back up, reaching the $1935 resistance at the time of writing confirming the strength of the trading strategy of buying gold from every lower level. The stability of the metal now awaits stronger catalysts to return to the vicinity of its recent record gains. The renewed global geopolitical tensions had a positive effect on gold investors, as investors sought to obtain a safe haven from the commodity after another sharp drop in stock prices, and the stability of the dollar against most other major currencies. Accordingly, the Dollar DXY Index rose to the 93.48 level, before erasing some of its gains, and settling around 93.30 now.

Silver futures closed higher at $26.991 an ounce, while copper futures settled at $3.0250 a pound.

Another strong round of selling in US tech stocks pushed the Nasdaq index down by more than 3% yesterday, and widespread losses in other sectors in the US and European markets prompted investors to buy the yellow metal. The Dow and S&P500 indexes are down more than 1.5% and 2% respectively, as escalating tensions between the United States and China, and reports showing a jump in coronavirus cases in several parts across Europe and India raised concerns about global economic growth. The Nasdaq Composite Index, home to Apple, Amazon, Zoom, Tesla and many other tech stocks that led the market's remarkable five-month comeback from its March lows, lost more than 10% after hitting an all-time high just four days ago - falling that is known in the market as a correction after recent record gains.

Between March 23 and September 2, the Nasdaq index jumped 75% while gains in the S&P500 exceeded 60% and the Dow Jones industrial average rose 56.5% as the stock market rebounded from its lows in the era of the pandemic. During that period, Apple became the first US company worth $2 trillion, and Zoom itself became more valuable than General Motors and Ford Motors combined.

Besides, the data results showed a sharp contraction in the Eurozone GDP in the second quarter. These results also supported the rise in the price of gold.

According to the technical analysis of gold: As I expected before, the $1900 resistance is still important for the continuation of the upward trend in the gold of gold and currently, the closest resistance levels are 1945, 1960, and 1985 respectively, which are important levels to strengthen the bulls' position to return to push the price to the top of the historical psychological resistance at $2000 dollars an ounce. We may witness a downward turn only if the bears push gold price back below $1880 an ounce. I still prefer to buy gold from every lower level. Global geopolitical tensions will not stop as long as Trump remains the president of the United States, in addition to the continuing negative impact of the Coronavirus on the global economy.