A state of cautious stability has dominated the gold performance since the beginning of trading this week, amid a stronger move by the bears, as the price of an ounce of gold stabilized around $1926 an ounce. Despite the recent poor gold performance in light of the dollar's recovery, The World Gold Council still expects further gains for gold and believes that the final part of gold's bullish trend for the 2020 year came very fast, but gold still has the potential for further growth. For its part, the World Gold Council recently published some interesting reports, so let’s analyze them and draw important conclusions for precious metals investors!

I will start with the July Investment Update: "Gold Reaches a Record level: Sprint or Marathon?" About the summer rise of the gold price, which pushed gold prices to a new record level. According to the WGC, the combination of increased uncertainty, accommodative monetary policy, very low-interest rates, positive price momentum, depreciating US dollar, and fears of rising inflation, resulted in record inflows of 734 tons into gold-backed ETFs in the first half of the year.

Global central banks have cut interest rates drastically, often in combination with quantitative easing and other unconventional policy measures. Governments have also agreed to massive rescue packages to support their domestic economies, and more may be needed. These initiatives have heightened concerns that easy money, not fundamentals, is fuelling the stock market rally and that all the extra money pumped into the system could lead to very high inflation or at least devaluation.

Although the WGC correctly predicted a price correction, given that the final stage of gold bullishness for 2020 has come very quickly, the Gold Industry Organization believes there is still room for further price rises. This is because the price of gold has more than doubled amid the Great Recession, while it has increased by just under 30 percent since the Covid-19 pandemic. And for me, given that history never repeats itself, but only in some cases, it would be naive to expect similar price movements. After all, QE is less scary today than it was a decade ago and we have yet to witness the financial crisis. Nevertheless, I agree that gold can go much higher, especially as the current macroeconomic environment looks more inflated than it did after the collapse of Lehman Brothers.

The other factor and the catalyst for the future of gold is that, with adjusting the price of gold in line with inflation, it is still much lower than the levels seen in 2011 or 1980. In fact, gold prices are about 9 and 18 percent lower than previous peaks. This was the reason why many analysts believe that gold still has a lot of potential. For example, Nicholas Johnson, a Pimco portfolio manager who focuses on commodities, also indicated that the real price of gold is currently below levels reached during the 2008 financial crisis.

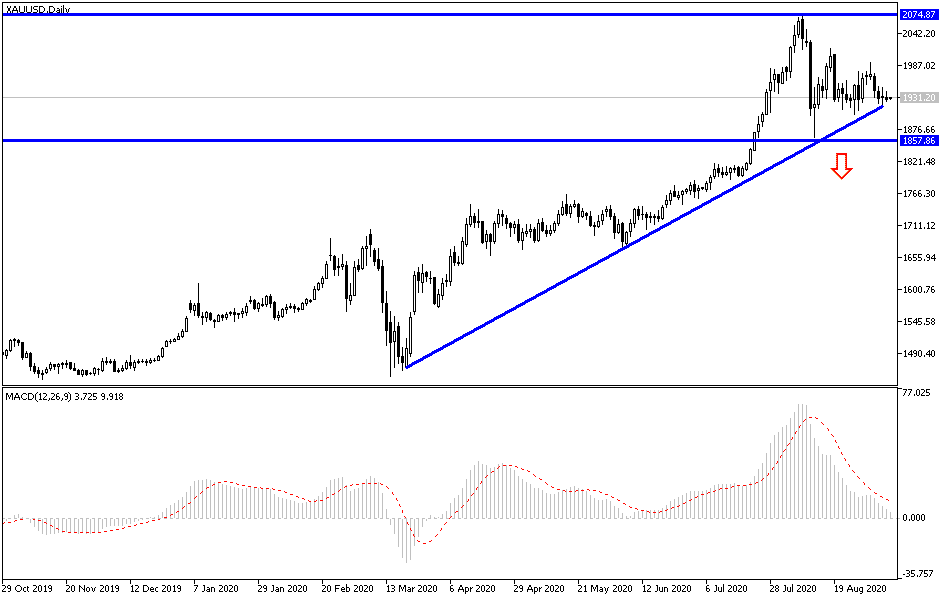

According to the technical analysis of gold: There is no change in the technical viewpoint as the general trend of gold is still bullish and the bulls are still ready to move towards the historical psychological resistance level at $2000 an ounce as soon as possible, as the USD’s strength is not expected to continue and the factors of gold gains are still in place, which are the Coronavirus, the tensions between the two largest economies in the world which never subside, and anxiety about Trump's future in the upcoming presidential election which will motivate investors to buy gold at every lower level. The closest support levels for gold are now 1919, 1900, and 1865, respectively. The price of gold will interact today with the announcement of the growth rate in the Japanese economy and the Eurozone.