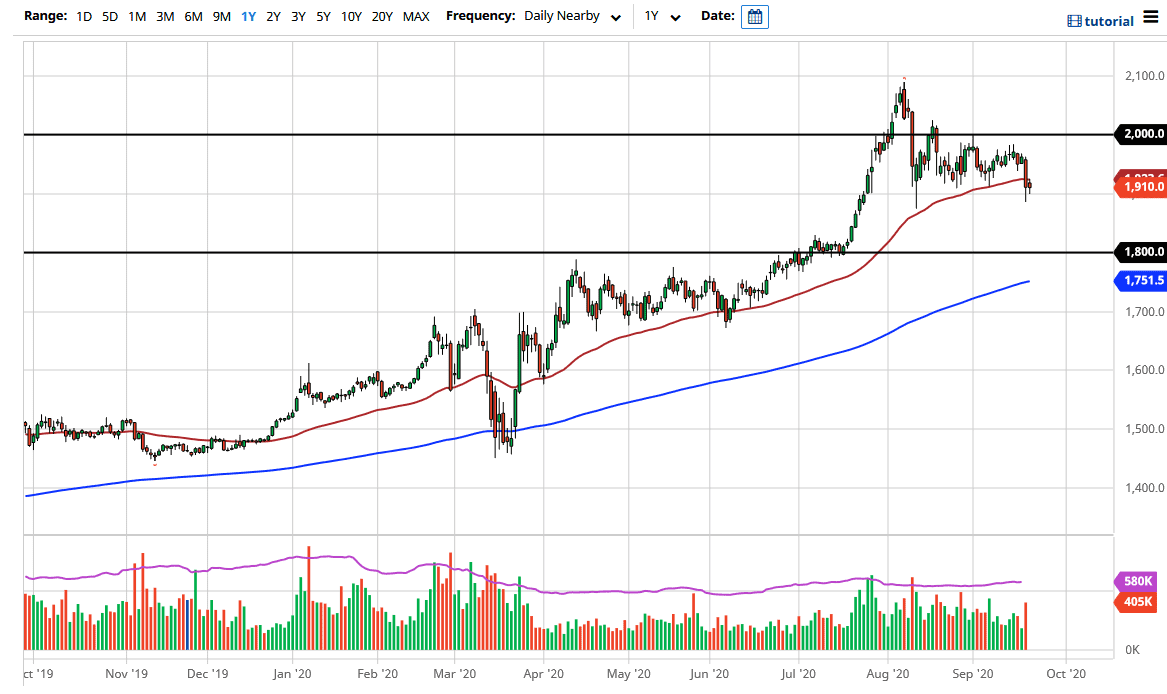

Gold markets fell again during the trading session on Tuesday but seem to be finding a bit of interest near the $1900 level. By doing so, the market looks as if it is ready to go in one direction or the other, and it is probable that we will finally see some type of resolution here. Ultimately, if we break down below the Monday lows, I believe that this is a market that will start to come undone. I do not necessarily think that it will be a selling opportunity, rather that it will be an attempt to go back towards even more supportive areas underneath, with special attention being paid to the $1800 level.

The size of the candlestick on Monday certainly leaves a lot to be desired if you are bullish of gold, and I am from a longer-term standpoint. However, I also recognize that we have a lot of crosswinds out there that could cause issues, not the least of which would be the US dollar strengthening, global concerns around the world, and the fact that central banks are flooding the market with liquidity.

The 50 day EMA still sits above, so that could cause a little bit of technical resistance. Given enough time, I think that the market will probably pay attention to that. This works both ways because we break above the 50 day EMA to attract enough attention that people will get involved. With that being said, I believe that the market will continue to pay more attention to the US dollar than anything else. I believe that this market could either break down from here or try to form some type of rounded bottom right in this area.

It is not until we break down below the $1800 level that I would be concerned, and it should be noted that the 200 day EMA is reaching towards that area. If we get the 200 day EMA and the $1800 level showing up at the same time could be very interesting from a longer-term “buy-and-hold” type of play. Having said all of that, if we were to eventually break down below the 200 day EMA it would probably show a major shift in attitude around the world. I guess the main take away from here is that the market was not nearly as bad as it could have been during the day, so you have to notch that into the “better than expected” column.