This is an area that is minor support, and if we turn around and rally, I think this will probably get sold into again. This will be especially true if the US dollar strengthens again, as the US dollar is negatively correlated to this market currently. Do not get me wrong, there are times where the US dollar and gold can move in the same direction, but over the last 90 days of correlation has been almost completely negative.

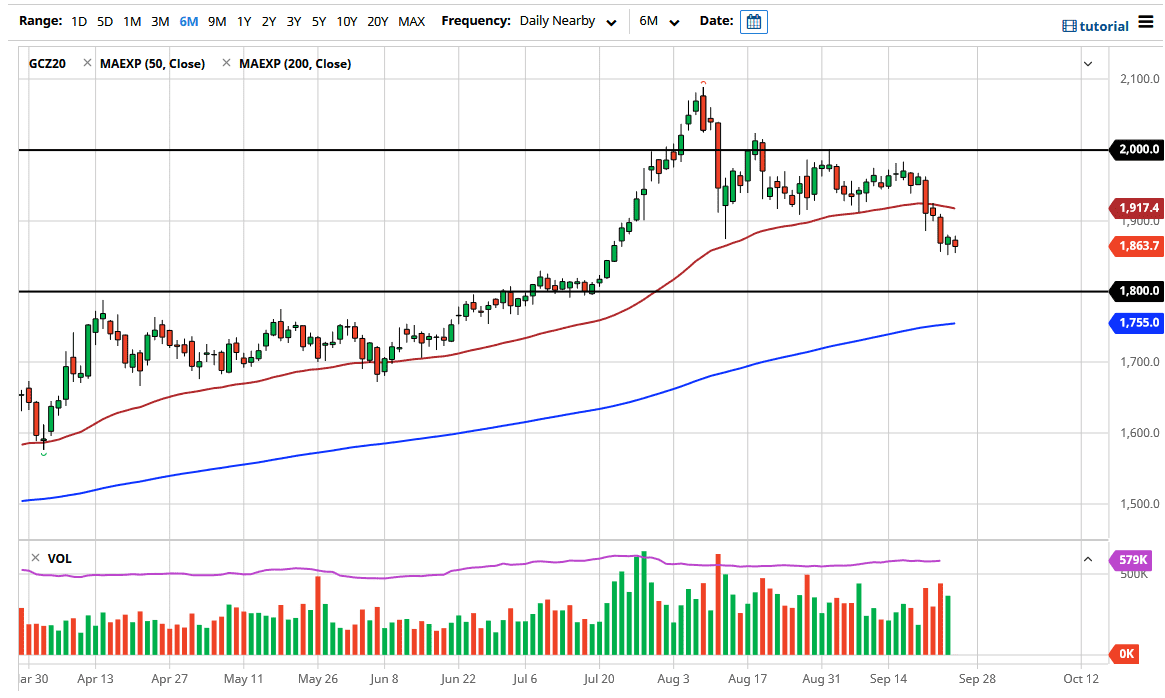

A market breaking down below the lows of the last couple of days would be very bearish, perhaps sending gold down towards the $18 level. That is an area where I think there would be plenty of buyers looking to get involved and pick up “cheap gold”, so therefore it is worth paying attention to. Furthermore, the 200 day EMA is getting close to this area and it is likely that we are going to see technical traders get involved at that area as well.

If we were to break down below the 200 day EMA it is possible that we could go looking towards the $1700 level, perhaps even lower than that. This would more than likely coincide nicely with the US dollar strengthening longer term. At this point, I do not expect that to happen but if it does that would be very toxic for gold. Having said that, that does not necessarily mean that we have to sell off. I know that most of you have been taught that gold and silver move in the same direction but that is not always the case. When it is a huge run towards safety, both of these markets can rally at the same time and that might be what we see before it is all said and done. However, in the initial push higher in the US dollar it does tend to weigh upon gold in general.

Central banks around the world continue to buy gold, so there is a large buyer in the market regardless. Furthermore, the uncertainty out there around the world continues to cause major concerns and people start looking towards safety and that of course means gold given enough time. I do think it is only a matter of time before gold rallies, but we may have a little bit of negativity in the short term to come into play before we can get long for a bigger move.