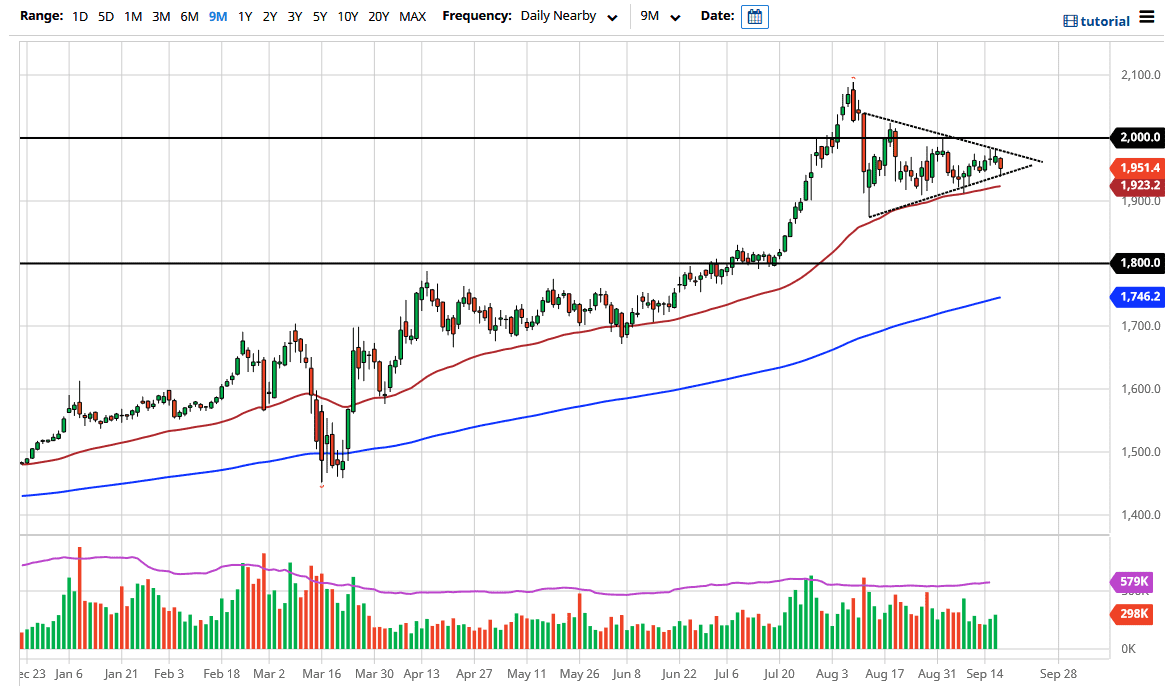

Gold markets fell hard during the trading session on Thursday, reaching down towards the uptrend line from the symmetric triangle that I have plotted on the chart. The $1950 level seems to be offering a bit of support, but quite frankly I think there is support at even lower levels just waiting to happen. Ultimately, I think that it is only a matter of time before we find value hunters jumping into this market, but I need to see some type of candlestick from which to hang my hat on.

The 50 day EMA underneath continues to rally, hanging around the $1923 level. Looking at this chart, we have been in an uptrend for some time and it does make sense that we would have to kill a little bit of time and digest the gains. The beginning of the summer started to see the US dollar get hammered, mainly due to Jerome Powell doing everything he can to catch on fire. This of course is good for commodities in general, not just gold. However, gold is clearly driven by not only the US dollar but also the idea of a lack of interest rates out there, as gold does not have any Carrie.

Looking at this chart, I do believe that we will eventually test the $2000 level, and depending on your timeframe, you may or may not even care about the specific entry. I believe that eventually we go above the $2000 level and go much higher. That does not necessarily mean you should jump “all in” though, but rather look at pullbacks as potential buying opportunities. I believe that the $1900 level will be massive support, and if we break down below there then I will simply step to the side and allow the market to reach towards the $1800 level which is even more structurally important to me as it was the scene of a major breakout. We have not retested that, so it would not necessarily be completely out of order for that to happen. Consequently, if we did reach towards that level, the 200 day EMA should come into the picture as well, so that adds even more credence to that level. Notice how I did not say anything about shorting gold, it simply is not a thought right now, at least not with all of the risk concerns out there.