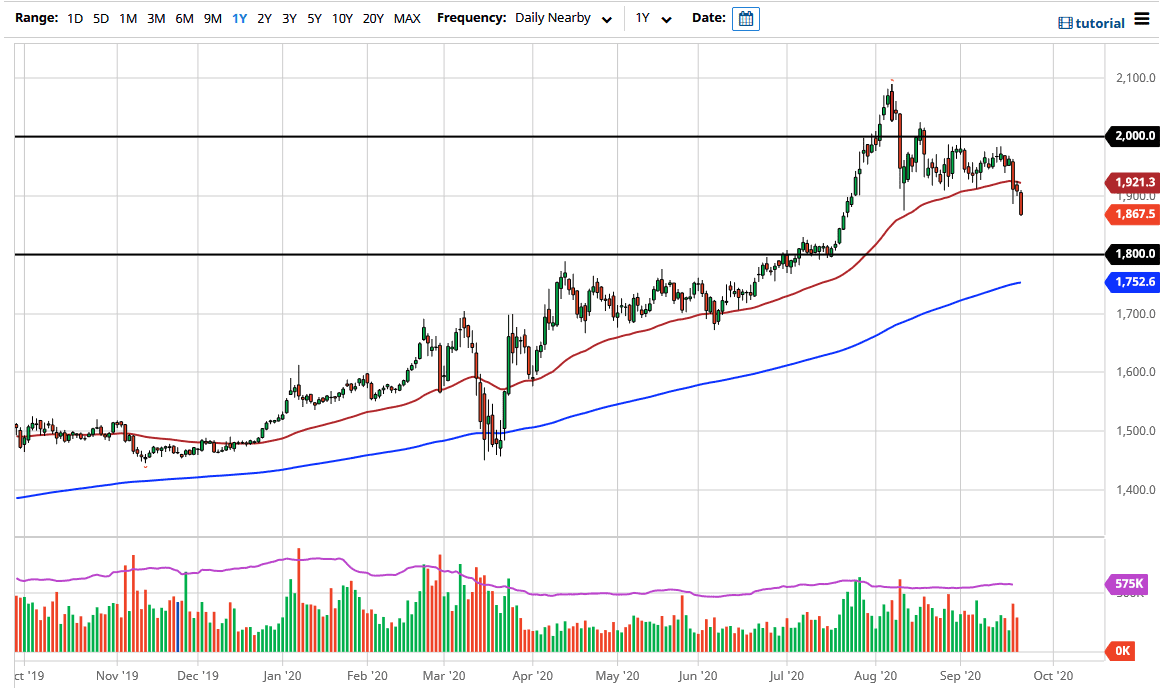

Gold looks horrible right now and it seems as if the US dollar is going to be the only game in town. With that in mind, I am looking for gold at cheaper levels, and if you have been following my analysis, you know that I have been talking about the $1800 level being a nice entry point. Now that we have had this candlestick for the Wednesday session, it looks very likely that I will get that opportunity. Furthermore, the 200 day EMA is reaching towards the $1800 level, so that offers yet another reason to believe that the market might be interested in going long there.

By closing towards the bottom of the candlestick, it does suggest that we are going to have continuation to the downside, and as a result I do believe that now that we are well below the 50 day EMA a lot of technical traders are bailing out. The 200 day EMA is currently at the $1750 level and moving much higher. I believe that this is going to be a bit of a “perfect storm” that we can take advantage of because there are a lot of concerns out there that will continue to be a major problem around the world when it comes to volatility and fear.

Looking at the $1900 level, I believe that it is significant resistance, and if we were to break back above there, then traders may feel a bit more comfortable in trying to take gold higher. However, this is going to be about the US dollar more than anything else, and as the US dollar strengthens it will almost certainly punish gold as well and is other precious metals. Commodities in general are getting crushed and it is likely that we are going to continue to see a lot of issues in this market so I would wait for some type of supportive candlestick or bullish candlestick to put money to work. In other words, look at daily closely is, not some type of short-term impulsive move, that is almost certainly going to be something that happens occasionally, and could also cause major issues. With all of this, I remain bullish longer term, but recognize we have further to go to the downside.