Gold markets broke down significantly during the trading session on Wednesday, as the US dollar has shot much higher during the trading session. That being said, it puts a lot of downward pressure on gold, as the market would be trying to buy those US dollars or at least cover markets that have gained. The gold markets have been extraordinarily bullish as of late, although the last couple of weeks have been a bit choppy.

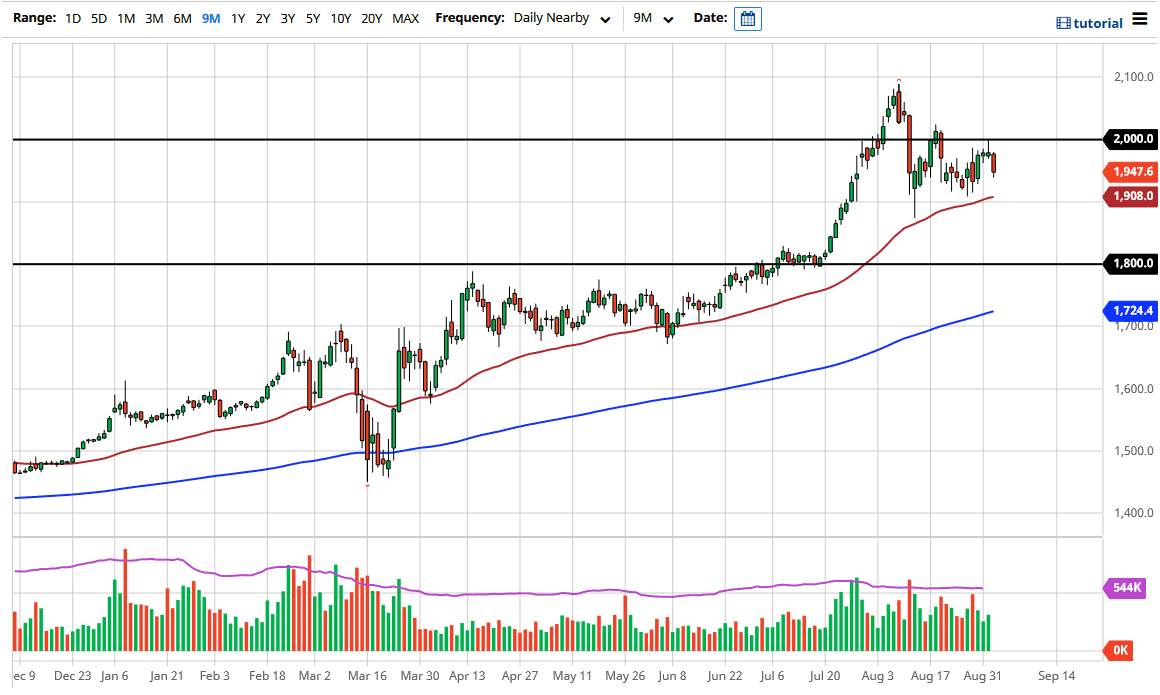

Looking at the chart, the 50 day EMA is sitting right at the $1900 level. This is a market that is going to continue to be noisy in general, but I think we are still in the midst of trying to form some type of bottoming pattern after the big break higher. Between the large, round, psychologically significant figure and the 50 day moving average, I think that a lot of traders will be paying quite a bit of attention in that region. If we break down below there, then it is likely that the market could go down to the $1800 level, an area that I think is much more significant as far as support is concerned because it was the scene of a major breakout.

It will come down to what happens on Friday with the US dollar, because it could give us an idea as to where we go next. All things being equal though, I think it is only a matter of time before we find a bit of a rounding bottom and perhaps a shot higher, but if we get some type of horrific number coming out of the jobs figures, that could send the US dollar crashing. After all, looking at the US dollar in general in the Forex markets, you can see that it is teetering on some kind of problem. Nonetheless, the next 48 hours could be a bit choppy and difficult in general. If we can turn around a break above the $2000 level, that could open up a move towards the $2100 level, and perhaps even breaking above there. If we do, then the market is likely to go looking towards the $2500 level over the longer term, which is my longer-term target. That does not mean we get there right away, and it does not even mean that we are going to be bullish over the next couple of days, but I do think that is what happens eventually.