Yesterday, the pair rallied from the 1.2774 support to the 1.2918 resistance before settling around the 1.2849 level at the time of writing . The sharp selling that the pair was exposed to amid a new failure of the Brexit negotiations pushed it towards the 1.2762 support, its lowest level in more than a month and a half. The British Pound suffered multiple setbacks throughout the month of September, dropping sharply against all other major currencies, making it the worst-performing major currency for 2020. The declines come as stalemate in the BREXIT negotiations between the European Union and the United Kingdom caused a state political uncertainty and strained relations between Brussels and London.

Last week saw the UK pass a Home Market Act designed to secure the UK's internal market performance from the start of 2021 when the country emerges from the Brexit transition period. In doing so, the bill seeks to rescind some elements of the withdrawal agreement reached between the European Union and the United Kingdom in December 2019, leading to explanations that the UK is willingly violating international law.

For its part, the United Kingdom said that this step is necessary to ensure the country's sanctity in the future, amid allegations that the European Union can use the withdrawal agreement to effectively ban the import of goods from the rest of the United Kingdom to Northern Ireland. The allegations made by the United Kingdom stem from the observation that the European Union did not guarantee the addition of Great Britain to the approved food import lists even though the European Union and the United Kingdom are currently working on a perfect alignment. By not including Great Britain on the list, the European Union would effectively dismantle the UK Internal Market Law.

In this regard, UK Chief Negotiator, David Frost said in a brief conversation on Twitter with his European Union counterpart Michel Barnier on Sunday, “It appeared to us in the current talks that there is no guarantee of our inclusion on the list. And I fear we were also told explicitly in these conversations that if we are not on the list, we will not be able to transport food to Northern Ireland.” Now the European Union is threatening a legal response and may not wait for the bill to be approved. It appears that the European Court of Justice will hear such a case until the formal arbitration panel for the withdrawal agreement is established in early 2021.

To make matters worse, the United Kingdom made a concession to Japan in the free trade agreement concluded in principle between them at the end of last week, which it refuses to submit to the European Union. In essence, Japan has simply turned around the deal it struck with the European Union that was implemented in 2019 that includes some broad restrictions on state aid. In its negotiations with the European Union, the United Kingdom insisted on absolute freedom within the framework of the World Trade Organization.

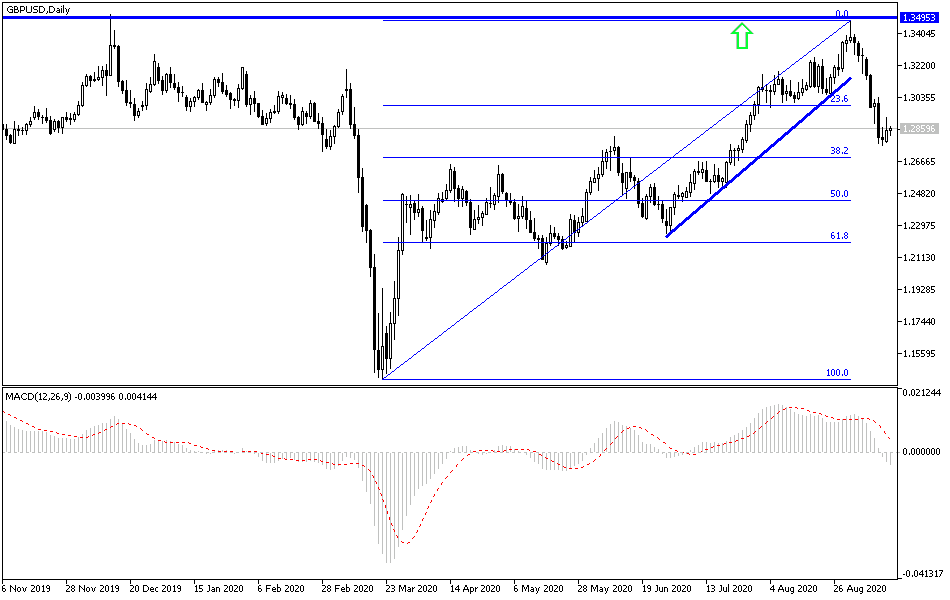

According to the technical analysis of the pair: GBP/USD gains will remain a selling target as long as the concern about the future of Brexit exists, and accordingly, the closest resistance levels for the pair are currently at 1.2920, 1.3000 and 1.3090, respectively, which may be appropriate to do so. According to the performance on the daily chart below, bears will continue to dominate the performance with the pair abandoning the 1.3000 resistance. The closest support levels for the pair are currently at 1.2790, 1.2700 and 1.2620, respectively.

As for the economic calendar data today: From Britain, the rate of change in employment, the unemployment rate in the country and the average wages will be announced. As for the dollar, the industrial production rate and the Empire State Industry Index will be announced.