Despite the pessimism that prevails in the markets towards the future of Brexit, the GBP/USD pair tried to correct to the upside, but gains did not exceed the 1.2925 resistance before settling around the 1.2885 level at the time of writing the analysis and before the announcement of British inflation figures and the monetary policy decisions of the US Federal Reserve. The current pound stability is still cautious, as expectations still indicate that more losses for the pound are likely in the near term, even if there remains a chance in the end for a deal between the European Union and the United Kingdom on a free trade agreement before the end of 2020.

Political uncertainty will remain high - conditions that usually help weaken the pound - especially after the British Parliament passed the first phase of the Home Market Bill with the government winning a 340 to 263 vote. There was speculation that a major revolt would take place among the Conservative Party, but this did not materialize in the end. In return, the European Union gave the United Kingdom until the end of the month to amend the controversial elements in the bill or face sanctions because some of the elements of legislation included in the bill would give the UK the right to override the elements of the withdrawal agreement.

With the UK’s intent on pursuing the legislation, the two sides appear poised for a confrontation that could ultimately lead to the collapse of trade negotiations altogether. Either way, the uncertainty will be high, and in this chaotic environment, the Pound is expected to remain under pressure of any power that ultimately proves to be limited, temporary, and subject to sale. As the UK prepares to pursue the domestic market law, all eyes will turn to the European Union’s retaliatory response, which may have an impact on how the British pound is traded in the coming weeks.

At the beginning of this week, it was reported that the European Union was considering delaying a decision to allow the City of London institutions the right to continue liquidating Euro transactions for clients residing in the European Union due to concerns about the UK’s plan to breach the Brexit settlement. The threat is considered significant due to the importance of the financial services sector to the UK economy, but it is also worth noting that the decision poses significant risks to EU companies that rely on London to clear foreign currencies.

London is by far the largest foreign exchange market in the world and according to data, it shows that the United Kingdom accounts for 43% of the global volume of forex transactions, while New York - its closest competitor - accounts for only 16.5% of global currency trade.

The European Union does not have the power in the market to replace London, and thus it appears that this move carries a high risk in the ongoing dispute over the UK’s decision to publish domestic legislation that would override the elements of the withdrawal agreement signed in late 2019. On the other hand, the European Commission said on Thursday, September 10, that the European Union will give the United Kingdom until the end of September to withdraw legislation it says seeks to undermine the withdrawal agreement reached between the two sides in 2019.

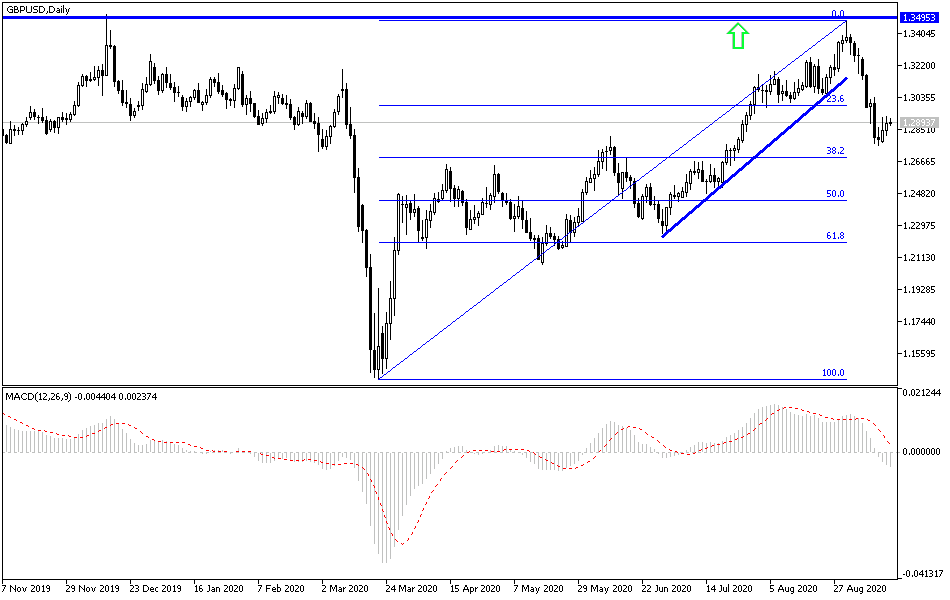

According to the technical analysis of the pair: Despite the GBP/USD recent correction attempts, the general trend of the pair is still down, and there will be no opportunity for a bullish correction and a return to the ascending channel path, that the pair abandoned two weeks ago, without the pair exceeding the 1.3260 resistance. According to the current situation, stability is still below the 1.30 level, which supports a stronger bears’ control, and the closest support levels for the pair are currently at 1.2855, 1.2780, and 1.2660, respectively. Overall, I would still prefer to sell the pair from every higher level.

As for the data on the economic calendar today: From Britain, inflation figures will be announced through the consumer price index, producer prices and retail prices. From the United States, retail sales figures, interest rate decision from the Federal Reserve Bank, its policy statement, and the statements of the bank’s governor, Jerome Powell, will be announced.