Increasing concern over the future of Brexit and the recovery of the USD caused a sharp collapse in GBP/USD currency pair, and accordingly, bears in the pair moved towards the 1.2950 support at the time of writing. We noted in the technical analyses that the pressure may lead the pair to 1.3000 psychological support, and from there, selling will increase. Currency traders are now thinking about the most appropriate buying levels after the pair collapsed from its highest levels in the year 2020 when it tested the 1.3483 resistance during last week's trading. We emphasize that the purchase should be cautious because markets are waiting for the results of the ongoing round of negotiations between the European Union and Britain to define the trade relations between them after the end of the transition period at the end of 2020.

Expectations are still pessimistic that the two parties will reach an agreement this week, but time is running out for everyone, and the final failure means a sharp collapse of the pound and for the European Union and Britain alike. The UK government is trying to impose a deadline in mid-October on European negotiators to reach a trade agreement while insisting that Brussels give up its demands for continued access rights to British waters and the so-called equal opportunity agreement that would grant continuing influence and control over many policy matters.

At the same time, British Prime Minister Boris Johnson is also seeking to impose a unilateral interpretation of the Brexit agreement under the guise of "clarifying" its terms. This apparently puts European Union leaders between a rock and a hard place where they must choose between something unambiguous and perhaps - They are unlikely to back down from their current position or impose a “no-deal” Brexit reality.

In general, a sharp Brexit is first a threat to the British economy and currency, but the Eurozone will not be affected by tariffs for goods and the increase in non-tariff barriers in services, so raising the value of the Euro in response to such an outcome will be unjustified. There was widespread speculation before the dollar's depreciation in 2020 that a “no-deal” Brexit would push the GBP/USD pair to at least the 1.15 support, but more likely to reach the 1.10 support. For his part, JP Morgan expects the pound to decline to 1.29 against the US dollar by the end of this month.

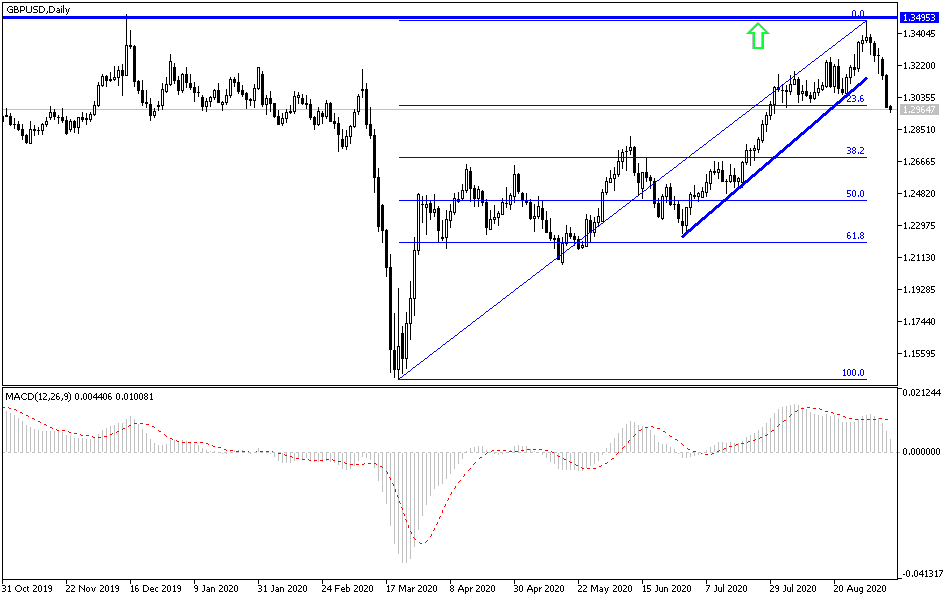

According to the technical analysis of the pair: As we have indicated in the recent technical analyses of the GBP/USD pair, the pair's decline towards the 1.3000 psychological support will be important for a stronger bear’s control and the pair may push on their impact to stronger support levels, which is what actually happened, and the closest support levels for the pair are currently at 1.2940 And 1.2880 and 1.2700, respectively, the last makes for a distinctive buying level, because it will push the indicators to strong oversold areas, and a rebound is expected from there. On the upside, there will be no opportunity for the bulls to control the performance again without moving the pair towards the 1.3200 resistance again. Otherwise, the current bearish trend will remain stronger.

Overall, I still prefer to sell the pair from every higher level. The pair does not expect any important and influential data, neither from Britain or the United States. It will interact more with indications regarding the outcome of the current Brexit round of negotiations.