As the pair jumped during yesterday's trading towards the 1.3482 resistance before the dollar strength returned along with profit-taking selling, the pair retreated towards the 1.3375 support at the beginning of today's trading. The US currency's gains increased after the stronger than expected results of the US ISM Manufacturing PMI for August. Last month's reading of the ISM Manufacturing PMI came in at 56, up from 54.2 in July, and ahead of a consensus for a more modest increase to just 54.6 for the last month, confirming other surveys as they indicated that the recovery in manufacturing in America had continued through August.

Commenting on the important index results, Andrew Grantham, economist at CIBC Capital Markets, said: "The survey still indicates that manufacturing in the US is recovering slightly faster after the closure than we initially expected."

New manufacturing orders rose more than six percent while backlogs continued to grow along with a tepid recovery in employment and overall output from the US industrial sector in August, the first full month in which the US economy was fully reopened. The growth in new orders was driven by higher domestic demand as well as customer demand for exports, which bodes well for the US economy as the end of the third quarter approaches, although the ISM Services PMI on Thursday is arguably more important to the outlook, as well as for the US dollar.

Generally speaking, PMI surveys measure changes in industry activity by asking respondents to rate employment levels, output, new orders, prices, deliveries, and inventories. The number above the 50.0 level indicates growth in the industry while the number below corresponds to contraction. Survey results are often linked to official measures of production, though they can often be off the mark as well.

On the British side, says Stephen Gallo, Head of Forex Strategy at BMO Capital Markets. “UK mortgage and consumer credit data for July confirmed lower activity in the third quarter as the quarterly GDP fell by -20% in the second quarter. After four consecutive months of deflation, net consumer credit rose by £ 1.2 billion (+ £ 0.8 billion projected) and 66,000 new mortgage loans were approved. Economic data strengthened the GBP/USD. But regardless of the dollar's movement, the pair is likely to continue to rise.”

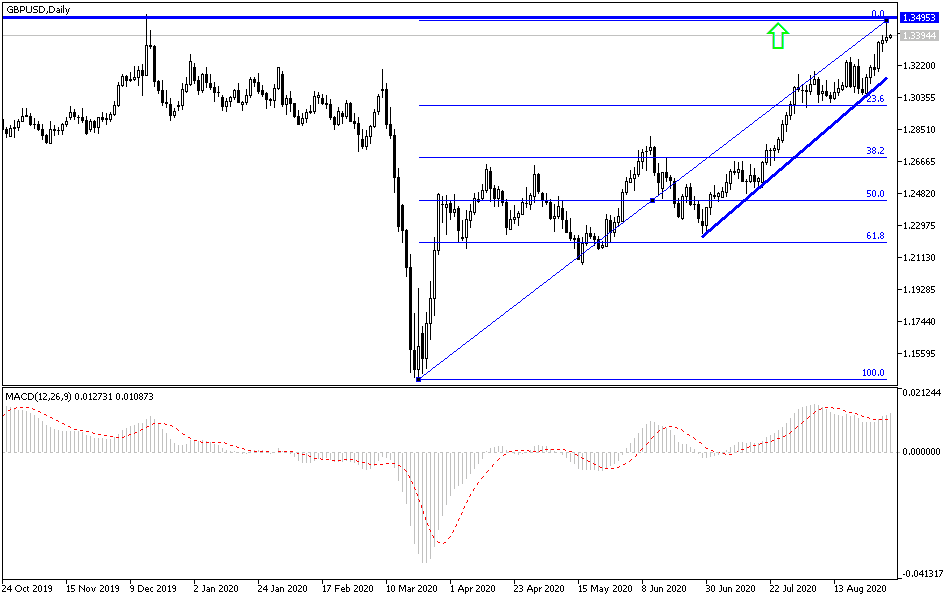

In general, the GBP/USD was already trimming its gains before the release of the ISM PMI, but it continued to decline from new 2020 highs after that, before settling above 1.34. In general, technical analysts warn that it will face obstacles in the coming period. “The GBP/USD pair is heading towards the 1.3500/15 top, its December 2019 high, and the lowest level in January 2009. Here we also find the 1.3522 2009-2020 resistance line (see monthly chart) and we will allow this to take a preliminary test. According to Fibonacci ratios, caution is warranted for more gains for the pair.” says Karen Jones, Head of Technical Analysis for Currencies, Commodities and Bonds at Commerzbank

According to the technical analysis of the pair: On the daily GBP/USD chart, the general trend is still upward, despite the pair abandoning its highest levels since the beginning of 2020. In general, stability above the 1.3400 resistance will motivate the bulls to push the pair towards the next most important resistance at 1.3515. Bears will not gain control again without moving towards the 1.3160 support. Despite the current pressure on the dollar, I still prefer selling the pair from every upward bounce.

Regarding the economic calendar data: From Britain, focus will be on Bank of England’s Governor comments. From the United States of America, ADP survey to measure the change in U.S non-farm employment, Then the announcement of US factory orders, as well as statements by several members of the US Federal Reserve that may explain their position on the changing of the bank's policy settings