The USD recovered and the selling operations that affected the GBP/USD currency pair, after testing its highest levels in 2020, pushed it towards the 1.3175 support at the end of last week’s trading before stabilizing at the beginning of this week’s trading around the 1.3260 level at the time of writing. Its sharp gains pushed it towards the 1.3482 resistance level, its highest since the beginning of the year. Currency dealers ignored the anxiety of a hard Brexit and the continuous failure of the negotiation rounds between the two sides. This week there will be a new round, the points of disagreement between them are still there, and the outlook is still bleak.

The next round of Brexit talks will start on Tuesday and may not help to boost positive feelings towards the British pound given the sharp rhetoric of British negotiators at the end of last week. The British Pound has not paid much attention to the talks recently, but some analysts expect this to change given that a “no-deal” Brexit can still happen at the end of the year while the two sides still have until mid-October to reach an agreement.

All in all, the pair continues to trade within a relatively bullish channel on the hourly chart and remains steady below the SMA lines for 100 hours and 200 hours. The rebound prevented it from falling to the oversold levels of the 14-hour RSI.

On the economic front, from Britain, the UK Construction PMI reading from Markit for August fell below expectations of 58.5, with a reading of 54.6. The services PMI reading came below expectations of 60.1, with a reading of 58.8. Prior to that, the manufacturing PMI reading was announced below expectations at 55.3, with a reading of 55.2, while July's consumer credit came in better than expected at 1.2 billion pounds compared to 0.637 billion pounds. M4 money supply decreased for July at 0.9% and expectations were at 1.5%. In contrast, mortgage approvals exceeded expectations by 54,839 thousand, recording 66.3 thousand.

From the United States, the most prominent were details of the US Labour Department report, as the US economy and in the non-agricultural sector returned a total of 1.37 million jobs, while expectations were for 1.4 million jobs to be added. Average hourly wage growth for the month beat expectations of 4.5% at 4.7% (YoY) while the US unemployment rate was affected by 8.4% compared to the expected rate of 9.8%. The labour force participation rate for the month slightly exceeded the projected rate of 61.4% with a participation rate of 61.7%. Prior to that, the ISM Manufacturing PMI reading was released, while the Services PMI came in below expectations.

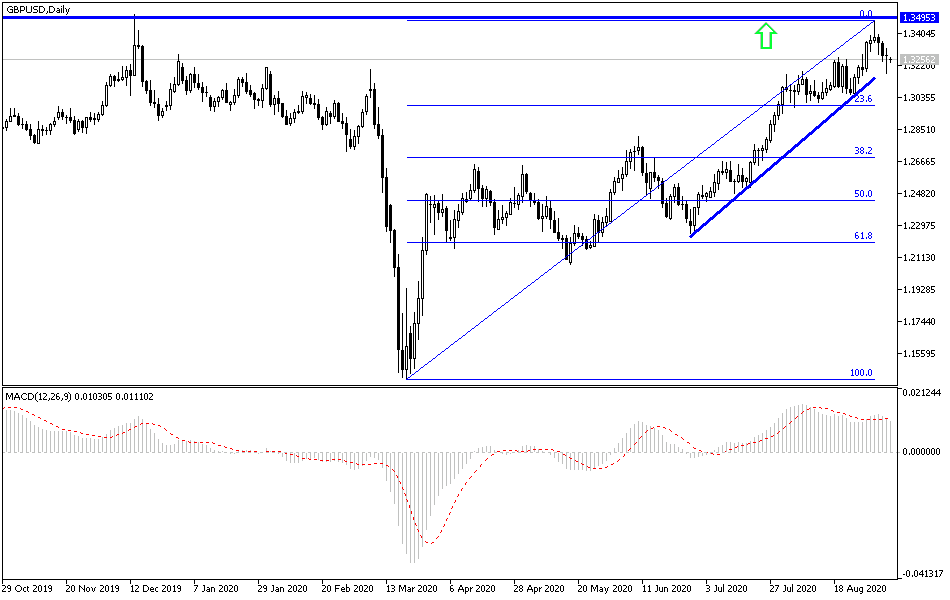

Technical Outlook for the GBP/USD: In the near term, it appears that the currency pair is trading within a bullish channel on the hourly chart. This indicates a short-term bullish bias in market sentiment. The pair recently bounced off the support trend line to avoid crossing into oversold levels of the 14-hour RSI. Accordingly, bulls will target short-term gains around the 1.3300 resistance or higher at the 1.3362 resistance. On the other hand, bears will be looking for profits around the 1.3180 support or below at the 1.3111 support.

In the long term, and based on the daily chart performance, it appears that the GBP/USD is trading within a sharp bullish channel. This indicates a strong long-term bullish bias in market sentiment. The recent pullback pushed the pair back to the normal trading range in the 14-day RSI. Accordingly, bulls will target long-term gains around the 1.3400 resistance or higher at 1.3515 resistance. On the other hand, bears will be looking for profits at around the 1.3022 support or below at the support 1.2795.