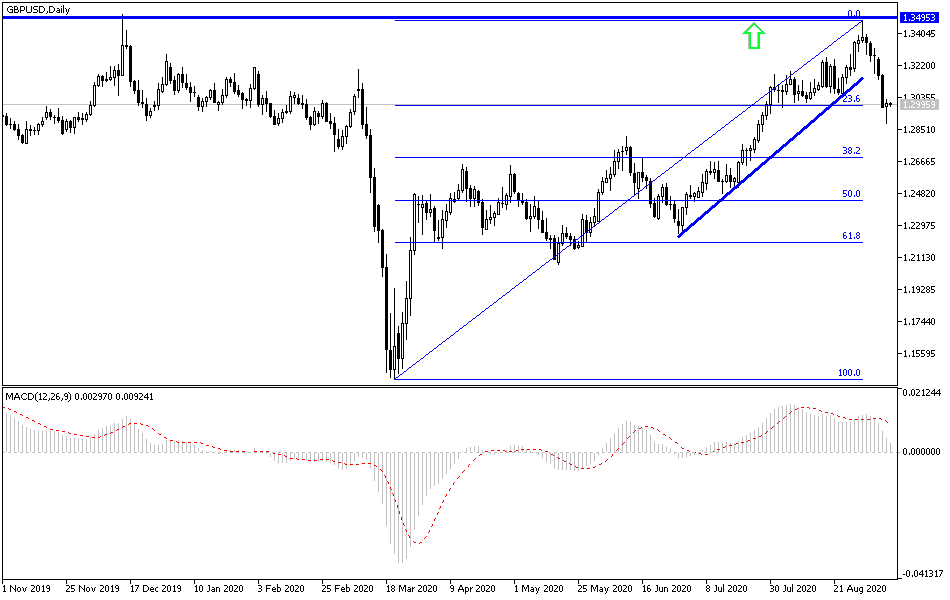

From today, signals will begin from the two sides of Brexit about the results of the ongoing round of negotiations this week, at a time when pessimism dominates the possibility of reaching an agreement between to chart the future of relations between them after the end of the Brexit transition period of at the end of this year. The USD recovered, and the fear of failure of negotiations pushed the price of the GBP/USD to move downwards towards the 1.2885 support, its lowest level in nearly a month and a half before the pair stabilized around the 1.3020 level at the time of writing. In general, the prospects for a trade deal between Britain and the European Union looked bleak, with the European Union saying that even the smallest British breach of the EU withdrawal treaty would undermine the remaining little trust between the two sides.

The warning came as Britain went ahead with passing legislation acknowledging that it violated international law by bypassing parts of the legally binding withdrawal agreement signed by Britain and the European Union. Commenting on this, European Union Council President Charles Michel said: "Violating international law is unacceptable and does not create the confidence we need to build our future relationship." The European Commission President, Ursula von der Leyen, also said that the old diplomatic cornerstone of “the need to preserve agreements” is “the foundation for prosperous future relations”. Germany had hoped that Britain would withdraw from the brink of the abyss, but France, the other economic and political power of the bloc, had scathing comments.

"We are ready to negotiate in good faith but to do that, we need to be two, so we are waiting for a good-faith interlocutor," said the French government spokesman, Gabriel Atal.

Britain left the political structures of the European Union on January 31, 2020, and will take an economic respite when an 11-month transition period ends on December 31. The two sides are trying to conclude a new trade deal by then, but talks have faltered. The UK government says its Domestic Market Bill is a "safety net" designed to prevent disruption of UK internal trade in the absence of an agreement by the end of the year.

The withdrawal agreement includes measures to ensure that there are no barriers to trade or travel between Northern Ireland, which is part of the United Kingdom, and Ireland, a member of the European Union. To do so, Britain agreed that Northern Ireland would continue to follow some EU rules even after the rest of the UK went their own way. This means that there will be controls and customs duties on some of the goods that are transported between Northern Ireland and the rest of the United Kingdom, with Britain and the European Union jointly deciding which goods to apply to.

If Parliament passes UK legislation, it would remove the EU's power to impose controls and customs fees in the absence of an agreement between the EU and the UK, giving that power instead to the UK government.

According to the technical analysis of the pair: According to what was mentioned above, it confirms the strength of our continuous trading strategy on the GBP/USD by selling from every higher level. The recent selling operations pushed some technical indicators into oversold areas, and therefore currency investors may consider buying the pair to gain from a bounce from the support areas at 1.2960, 1.2880, and 1.2790, respectively. There will be no opportunity for the bulls to control the performance again without the pair moving above the 1.3230 resistance, which increases the momentum to move towards its highest levels during 2020 again.

Regarding the economic calendar data today: From Britain, the GDP assessment from NIESR will be announced. From the United States, the important weekly jobless claims and the PPI reading will be announced.