The demand for the US currency as a safe haven increased. At the same time, the pressure on the pound increased from the Bank of England's signals about the possibility of imposing negative interest rates as well as the unknown future of Brexit. Therefore, it was natural for GBP/USD sales to increase as the pair collapsed to the 1.2775 support and is stabilizing around there at the time of writing, in the same range as last week’s, after failing to overcome the 1.3000 resistance. The sterling faces a new pressure factor, which is the announcement of new restrictions in the United Kingdom aimed at stopping the spread of the Coronavirus. While it is also said that the decline in global stock markets and the continuing concerns about Britain's exit from the European Union also contributed to the weakness of the Pound.

There was a hearing session of British Prime Minister Boris Johnson in front of the British Parliament yesterday to put forward the government's statement on the new cases of coronavirus. Journalists in leading UK newspapers and broadcasters reported widely on Tuesday that the base announcement would see the prime minister announce that pubs will be required to close bars at 10 pm on Thursday and only allow table service. However, and perhaps most important economically, some journalists also stated that Johnson would drop inviting workers to return to the offices.

The developments are seen as a mixed bag for the British economy. On the one hand, the hospitality sector, which is a significant employer and source of economic activity, remains open and appears to be exiting a little. On the other hand, preventing workers from returning to offices is a major blow to major centers such as London, which are the beating heart of the UK economy. Accordingly, the British pound fell at the beginning of this week's trading, amid fears of a new nationwide lockdown after the leading medical scientists in the United Kingdom held a press conference and confirmed that unless the country changes its course, the United Kingdom may witness infection cases reaching 50 thousand daily in October. The warnings were seen as an attempt to pave the way for more government intervention.

The Covid-19 restrictions are significant for the British pound, which was one of the worst-performing major currencies during the March-June period due to the prolonged strict lockdown in the UK. The British currency recovered from July to August as the British economy was freed from closure and sectors began to reopen, resulting in a strong economic recovery. However, renewed concerns about restrictions in the fall could derail the recovery and contribute to the weak performance of the British Pound in the coming weeks.

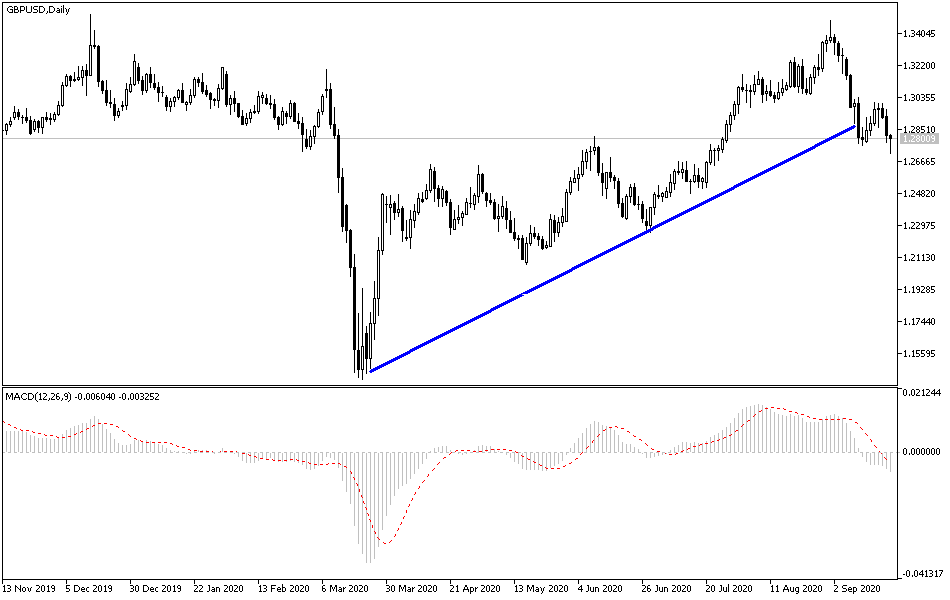

According to the technical analysis of the pair: The bearish momentum of the GBP/USD pair is getting stronger since the pair abandoned the 1.3000 resistance, the most important for the ascending path, as per the performance on the daily chart. The ongoing selling operations may push the pair towards stronger support levels, which are currently closest to 1.2765, 1.2660, and 1.2580, respectively. And as expected before, concerns about the future of Brexit will continue to be the most influencing factor for any gains in the Pound. On the upside, breaching the 1.3000 resistance will remain a first step for the bulls to return to control performance.

Today the pair will interact a lot with Bank of England Governor's remarks and the content of Fed Governor Jerome Powell's testimony.