The pair stabilized around the 1.3284 support after its gains this week that pushed it to the 1.3482 resistance. The correction came with the recovery of the US dollar, which collapsed to its lowest levels in two years, amid markets concern regarding the change in the US Central Bank policy, the statements of Brexit negotiators from the European Union, and the Bank of England Governor’s Andrew Bailey help to reverse the sterling’s recent moves in the currency market.

The losses weakened the sterling prices after Governor Bailey and his colleagues appeared before a Parliamentary Select Committee, where words of caution and statements of concern about the economy came after new complaints from Brexit negotiators.

“Barnier from the European Union is providing another bleak update to the Brexit negotiations, but the GBP/USD is showing a very muted reaction,” said Eric Briegar, head of foreign exchange strategy at Exchange Bank of Canada, before Pelly appeared in Parliament, Bank of England Governor told MPs that the recovery in consumer spending was very fast but was not matched by a rebound in business investment before confirming that negative interest rates were still in the bank's toolbox but were unlikely to be used at this time.

He also warned of short-term increases in inflation, which could harm British government bonds in global markets, while Monetary Policy Committee member Gertjan Flagg told lawmakers that it could take years for the economy to fully recover from the disruptions associated with the Coronavirus. What is clear is that the British economy will need to be reshaped in order to recover. A sharp rise in unemployment is expected when the vacation scheme ends, as companies increasingly looking at automation in order to fill gaps in their workforce and help control costs.

As such, some sectors and industries could be wiped out even though consumption returns to pre-pandemic levels. So, Paul Craig, portfolio manager at Quilter Investors, says, "It is becoming more and more evident that the British government will need to step in with more targeted financial support and provide more support to job seekers."

Despite the pound’s weak performance, it kept its gains against the struggling Euro, which is an indicator of global factors that play a role in affecting performance, but the pound to the Euro price swung to a loss after remarks by various Bank of England employees in Parliament on Wednesday. The EUR/GBP has stabilized mostly above 1.12 after regaining that level late last week, and technical analysts at Commerzbank say it might now target 1.1281, but it also has room to reach 1.1390.

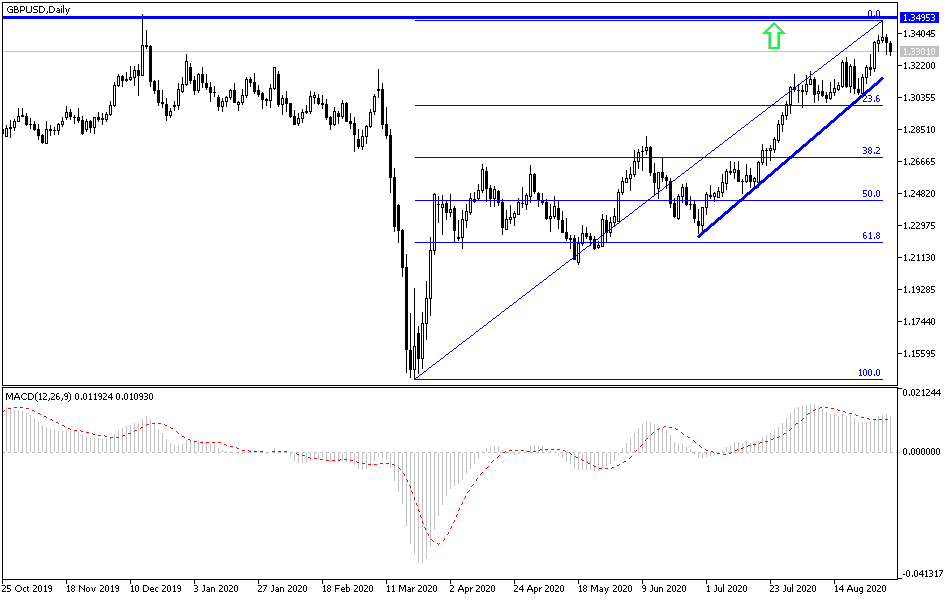

Commenting on the Pound’s performance, Karen Jones, Head of Technical Analysis for Currencies at Commerzbank says, “The EUR/GBP is still under pressure and appears poised for a slide to 0.864, the lowest level from June 9, and we believe that there is a possibility of reaching the 200 day moving average at 0.8779 ”. On the other hand, the GBP/USD is preparing to face 1.3500/15, the highest level reached in December 2019 and the lowest level in January 2009 ″.

According to the technical analysis of the pair: Despite the recent performance, the GBP/USD currency pair still has the opportunity to rise as long as it is stable above the resistance levels of 1.30 and 1.33. As I mentioned before, it is clear in the performance, I still prefer selling the pair from every higher level. The closest resistance levels for the pair now are 1.3385, 1.3460 and 1.3550, respectively. According to the performance on the daily chart, the pair will not have a real reversal of the trend without moving towards the 1.3000 support level.

As for the data on the economic calendar today: From Britain, the services PMI and upcoming statements by the Bank of England Governor will be announced. From the United States, the jobless claims, the trade balance and non-agricultural productivity will be announced, and then the ISM Services PMI will be released.