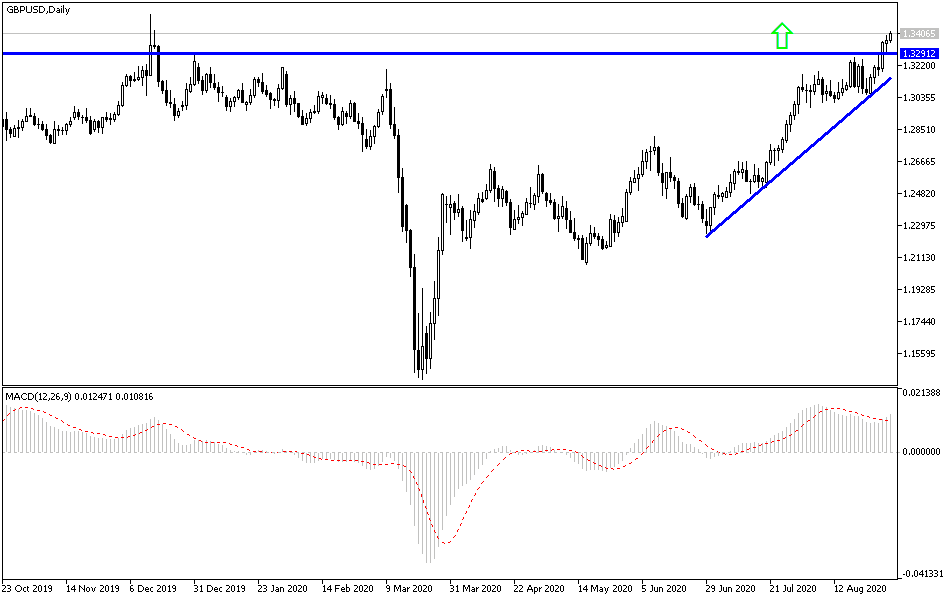

The GBP/USD performance highlights the extent of the US currency suffering, as with the bleak outlook for Brexit, the pair succeeded in moving upwards towards the 1.3418 resistance at the time of writing, the highest level in eight months. Nevertheless, I still believe that the continuing uncertainty about Brexit, the US economic resilience, and the excessive selling of the dollar may slow the pair's rise to stronger levels. The dollar selling increased after the US central bank said during the annual Jackson Hole symposium that it would intentionally boost inflation above target and that interest rates would remain low for longer periods.

The shift in US monetary policy was in line with what many analysts had been expecting but indicates a further decline in "real" bond yields, or inflation-adjusted returns, that investors have achieved, which is widely referred to as behind the declines in the dollar's value over recent months, especially late last week.

The weakness of the US currency against the rest of other major currencies pushed the EUR/USD and AUD/USD pair to the levels last seen in early 2018, while the USD/JPY pair reached its lowest levels in 2017 and the USD/CHF pair found its way to its lowest level in five years, but the price of the GBP/USD returned to its highest levels in March 2020. For some investors, this may mean that the price of the pair is now an ideal way to express the bearish sentiment of the US dollar. In this regard, Juan Manuel Herrera, Scotiabank strategist, says: “We remain optimistic about the outlook for the British pound from a technical point of view, and we are looking for gains to extend towards 1.35 on the break above 1.3265 ″. According to a similar opinion, David Sneddon, head of the technical analysis research firm at Credit Suisse, says: “Once it crosses the 1.3519 high, the pound will trade at its highest levels since early 2018.”

Long-term expectations that the pound will trade around the 1.40 high or higher against the dollar if it keeps pace with the gains of the Euro, the Australian, and other currencies in the 2020 advance against the greenback. The British pound fell sharply against all major currencies again in May and slipped below the level of many competitors in the months that followed, amid concerns over the economy, monetary policy of the Bank of England (BoE), and the path of Brexit trade talks. Brexit negotiations remain at deadlocked, although The Express reported last Friday that Michel Barnier of Brussels informed European capitals that they might need to review his mandate in order to make progress in the talks, indicating a possible move from the European side.

The trade talks will not resume in earnest until the second week of September although the lack of progress towards a deal represents headwinds and a weaker pound.

According to the technical analysis of the pair: On the daily chart, the reversal of the GBP/USD general trend upwards is getting stronger, and at the same time, the 1.3455 and 1.3515 resistance levels may be the target of selling operations to gain a bounce with potential profit-taking sales at any time, considering the arrival of technical indicators to overbought areas. Bears will regain control of the performance in case the pair heads below the 1.3200 support level.

As for the economic calendar data today: From Britain, the industrial PMI reading will be announced. From the United States, the ISM manufacturing PMI and construction spending index will be announced.