The recovery of the dollar, anxiety about the future of Brexit, the possibility of imposing interest rates, and the re-closure of the British economy are all factors that contributed strongly to the collapse of the GBP/USD to the 1.2710 support. This is its lowest level in two months, before stabilizing around 1.2740 at the time of writing and before the announcement of important economic data. The bears’ control is still the strongest, and the pair may be exposed to more selling if the above factors persist. Yesterday, the British government announced a number of new and comic restrictions in some places on the freedoms of companies and families, while it says that they are precautionary measures to contain an increasing second wave of Coronavirus infections.

The details of the new dictations came amid a widespread recovery in the dollar's exchange rates, as the US currency rose strongly against the rest of other major currencies due to concerns over the European economic outlook, as it proved that panic among politicians is as contagious as the virus itself.

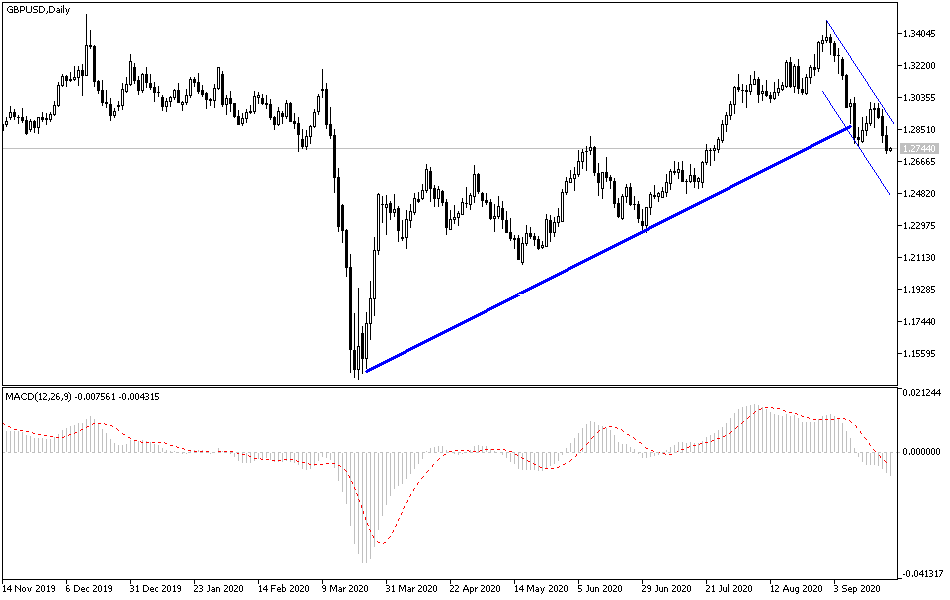

Commenting on the recent performance of the pair, Karen Jones, Head of Technical Analysis for Currencies, Commodities, and Bonds at Commerzbank said: “The loss of 1.2690 Fibonacci support should be sufficient to trigger the next slide to the support levels at 1.2445 then 1.2250/1.2200”. “It appears that the GBP/USD rebound from the 200-day moving average at 1.2724 has ended, and while it was capped at the 20-day moving average at 1.3070, the bearish bias was maintained.”

The GBP/USD was on its way to collide with the 38.2% Fibonacci retracement of its March-August recovery located around 1.2690 after tumbling below the 200-day moving average at 1.2723. It fell -0.80% to 1.2710, marking a third straight day of losses in the British currency. Accordingly, Jones and the Commerzbank team are selling GBP/USD from 1.2970 and have set 1.2250 as a target price, a level we have not seen since late May, the month in which the British pound fell sharply against all major currencies.

The British pound enjoyed a tepid rally earlier in yesterday's trading session after Bank of England Governor Andrew Bailey tried to backtrack on some of the Bank of England's previous suggestions that it is considering implementing negative interest rates. Bailey said that the bank did not threaten negative interest rates in its recent policy announcement and that policymakers are looking to understand more about the potential impact of these rates on the economy and the financial system. It was recently revealed that the Bank of England “will initiate a structured engagement on operational considerations in the fourth quarter of 2020”, and that “the committee has discussed its own set of policy instruments and the effectiveness of negative interest rates in particular”. However, at this point, the BoE may be more than an afterthought for the pound sterling, given that the economy is besieged by government technocrats, and a “No-Deal Brexit” after the transition period ends at the end of 2020 is still a direct threat to the economy and the currency.

According to the technical analysis of the pair: on the daily GBP/USD chart, there is a clear break of the uptrend. It means more losses, and the support levels at 1.2675, 1.2590, and 1.2480, respectively, may be the next targets for the bears. On the upside, there will be no initial chance for an upward correction without surpassing the 1.3000 resistance level.

As for the economic calendar data today: From the UK, the PMI reading for the manufacturing and services sectors will be announced. Then to the US session and the announcement of the PMI readings for the manufacturing and services sectors, then to the second testimony of Federal Reserve Governor Jerome Powell.