Pound's losses continue and may extend for a longer period, as instead of an improvement, the pressure increases. The recent GBP/USD selling pushed it to the 1.2674 support, its lowest level in two months before settling around the 1.2700 support at the time of writing. This is in anticipation for an important day that will include statements of monetary policy officials from Britain and the United States, which will have the largest impact on the pair’s performance. The Pound ignored claims of progress in trade talks on Brexit, and suggestions that any final deal could come with a period of "execution" and government promises to increase investment spending. Yesterday, British Prime Minister Boris Johnson said that the government is looking into a major investment package aimed at protecting jobs and helping the economy, ahead of an expected statement to Parliament from Chancellor Rishi Sunak at 12:30 on Thursday.

This was before Cabinet Office Minister Michael Gove said trade talks on Brexit were "progressing" well, after a briefing that spoke about problems on Kent's approach in the event of a "no-deal" Brexit from the transition period.

On the economic side. A quick survey data from IHS Markit showed that UK private sector growth slowed in September due to ongoing disruptions to business operations caused by the coronavirus. Accordingly, the composite production index - which includes the manufacturing and services sectors - decreased to a reading of 55.7 from 59.1 in the previous month. The result was expected to moderately decrease to 56.3.

The slowdown reflected weaker increases in both industrial production and service sector activity.

The Services PMI came in at 55.1, down from 58.8 a month ago and below economists' expectations of 56.0. Likewise, the manufacturing PMI decreased to 54.3 in September from 55.2 in the previous month. The expected reading was 54.1. Commenting on the findings, Chris Williamson, chief business economist at IHS Markit, said, “The survey indicates that growth momentum is being lost quickly when policy support is withdrawn, which underscores our concern about the path of the labour market once the holiday scheme expires next month, and raises concerns that growth may fade further as we are close to the winter months. , "Especially with the tightening of lockdown measures further."

Thomas Pugh, an economist at Capital Economics, also said it now appears likely that the new restrictions will set back the economic recovery and cause GDP to stagnate in the fourth quarter. The biggest risk is that the government has to go further.

The volume of new business across the private sector rose at the weakest pace in three months in September. Employment numbers continued to decline sharply in September as the anticipated shutdown of the government leave system accelerated the decision-making process on employment levels.

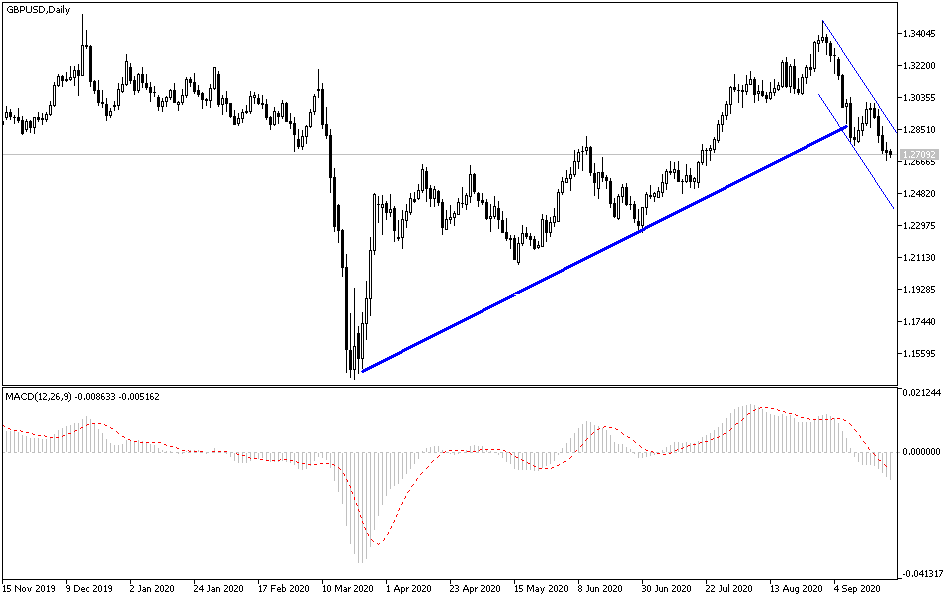

According to the technical analysis of the pair: There is no change in my technical view of the GBP/USD. On the daily chart, the general trend is still bearish, as it moves inside the descending channel formation with a clear stability, and therefore, the next bears' targets may be 1.2635, 1.2580 and 1.2490, respectively. According to the current performance, any chance of bouncing back to the highest selling target will be a selling target again. There will be no opportunity to reverse the current trend without returning to cross the 1.3000 psychological resistance, which was a psychological support before the trend shifted at the beginning of this month's trading.

Regarding today's economic calendar data: First, statements by the Governor of the Bank of England. During the US session, jobless claims and new US home sales and statements by both Federal Reserve Governor Jerome Powell and the US Treasury Secretary.