Cautious stability of the GBP/USD price ahead of the Bank of England’s announcement of its monetary policy decisions later today, Thursday. Bulls succeeded in pushing the pair towards the 1.3007 resistance level before collapsing to the 1.2900 support this morning and stabilizing around the 1.2940 level at the time of writing. The Bank of England's announcement comes hours after the US Central Bank announced its monetary policy decisions, in which it kept US interest rates at their historically low levels, and what confused the markets was the bank’s suggestion that it would keep rates at zero until 2024 as long as the coronavirus has a strong negative impact on International Economy. The stability of the pound against the rest of major currencies comes in light of signs indicating that the UK government could back down in a dispute with the European Union and ease controversial legislation that raised tensions between the two sides to the extent that a no-deal BREXIT would be expected.

British Attorney General Robert Buckland hinted today that the government could amend the Home Market Bill in order to reach a compromise with opponents of the Conservative Party who argue that the current form of legislation opens the door for the UK to breach an international treaty, especially with a subsequent BBC report confirming that maneuvers were underway. In this regard, says Chris Beauchamp, Senior Market Analyst at IG, that any concessions, in turn, could ultimately allow the European Union to revert to threats to take legal action unless the UK withdraws the bill by the end of the month. “Therefore, the pound strengthened due to reports that the government is close to a settlement with MPs opposing the internal markets bill. If the rebels can be appeased, the chances of returning to negotiations with the European Union will increase”.

Meanwhile, BBC correspondent Laura Koensberg said on Wednesday afternoon that she was aware that an agreement had been reached between the Conservatives who wanted to vote in favor of Bob Neal's amendment to the Internal Markets Act and the government that provides an extra layer of parliamentary oversight over the legislation. For his part, Queensberg says the government ministers hope that the compromise will prevent a revolt among British MPs.

For its part, the European Union says that the Home Market Law allows the UK to unilaterally override elements of last year's withdrawal agreement between the European Union and the UK, which they say amounts to a violation of international law and makes the prospects for a trade deal more difficult. The UK says the legislation is necessary to prevent the EU from preventing the export of food from the rest of the UK to Northern Ireland if the EU refuses to add the UK to its list of food trade partners from the three countries.

Conservative party members opposed to the bill are calling for a change to allow Parliament to veto any attempts by the government to effectively violate the withdrawal agreement.

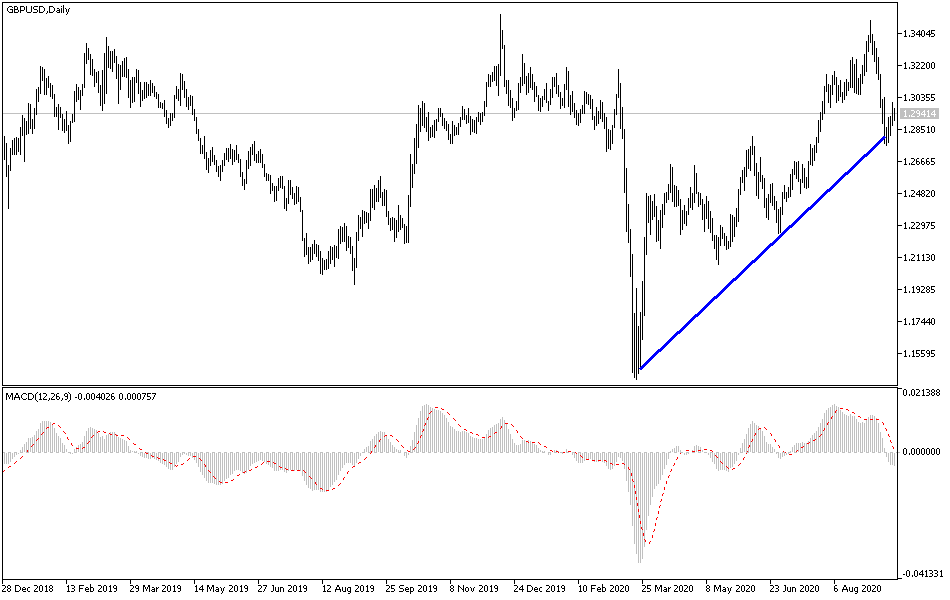

According to the technical analysis of the pair: Stability below the 1.3000 level will continue to support the strength of the downward momentum of the GBP/USD price which suffers mainly from the anxiety of the future of Britain's exit from the European Union. The current bears' control over the performance may support the pair's move towards the support levels of 1.2880, 1.2800, and 1.2735 respectively during the week's trading, in case the two sides of the Brexit insist on their current hostile stance. As I mentioned before, the pair will not have a chance for a bullish correction without crossing the resistance barrier at 1.3265. Overall, I would still prefer to sell the pair from every upper level.

Regarding today's economic calendar data: From Britain, members of the Bank of England's monetary policy vote on interest rates and asset-buying plans, and expectations indicate that the bank maintains its policy as is, and therefore the Brexit path will remain the most influential on the Pound. From the United States, the Philadelphia Industrial Index reading, jobless claims, building permits, and housing starts will be announced.