The US currency recovered alongside renewed fears of a bleaker outlook for Brexit, after Boris Johnson - Britain's prime minister - threatened by saying it was too late for an agreement. These factors contributed to the continuation of the GBP/USD selling, which collapsed to the 1.3140 support in the beginning of this week’s trading, before stabilizing around 1.3165 at the beginning of Tuesday trading. Adding to the pressure on the sterling was the losses in global stock markets amid strong profit-taking selling after the recent record profits, which were referred to as exaggerated.

In this regard, George Vessy, a currency strategist at Western Union, says: “The GBP/USD has positively correlated with US stocks in recent months, so the decline in US stocks has led to the decline of the pair as well". Recently, technology stocks, such as Apple, Microsoft, Facebook and Tesla, have suffered significant declines amid fears of an overestimation of their value after a strong wave that saw the sector surpass its lowest levels in March that were identified during the market crash affected by the consequences of the Coronavirus. Accordingly, some analysts argue that a shift from technology stocks to other undervalued sectors may occur because of the now questionable technology valuations.

The link between the pound sterling and the US stock markets, which is in fact a more comprehensive proxy for investor sentiment, was highlighted more sharply last March when global markets collapsed in the face of Covid-19 pandemic, and accordingly, the pound fell to its lowest levels in several years against both The Euro and the USD. Nick Bovell, chief investment officer at Bovell Global Macro, said: “The move in the British pound is simply part of the broad movement in risk assets and the buying of the US dollar, and has nothing to do with Brexit.” And added: “So the market continues to price in light of almost zero risks from No-Deal Brexit, while banking analysts peg the risk at around 30%."

Some forex analysts say one of the drivers of the pound's losses is the ongoing negative sentiment over trade negotiations between the European Union and the United Kingdom after Brexit, yet there were no new headlines on the talks last Thursday. However, there was a feeling that the pound rallied to a 12-week high against the Euro - which is often seen as a benchmark for Brexit sentiment.

The pound recovered from July to August against most of the major currencies, thanks to the apparent lack of tangible headlines regarding the status of Brexit negotiations, while the reopening of the economy led to a resurgence in the economy and restored many of the previous crashes. During the next month, there will be important events, and there may be a strong fluctuation for the pound. These events are represented in the meeting of European Union leaders in mid-October to try and agree on the remaining results. This is in addition to the conclusion of the British government's plans to maintain jobs in the country.

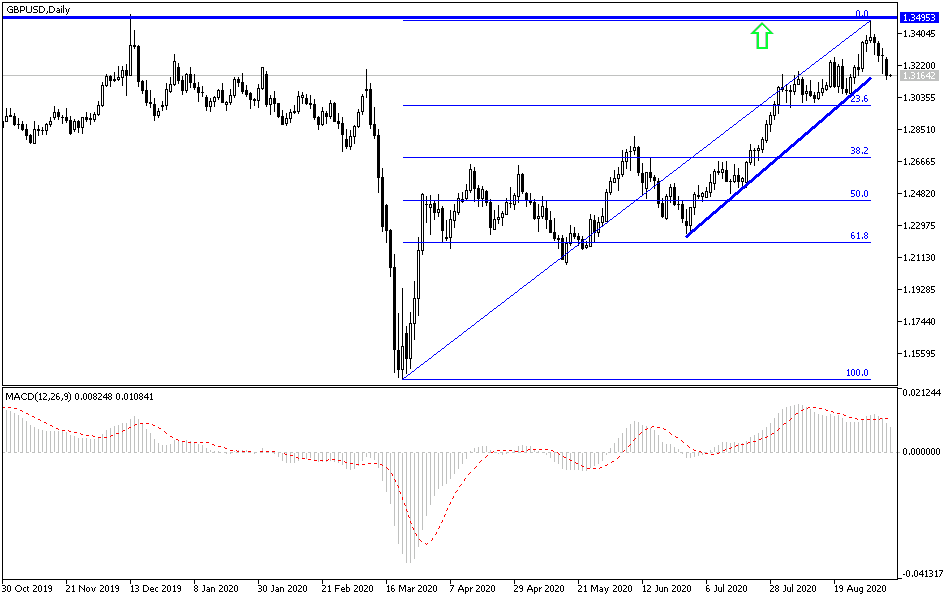

According to the technical analysis of the pair: The success of the bears in pushing the GBP/USD pair below the 1.3100 support will increase the technical pressure on the pair to move towards the 1.3000 psychological support, and according to the daily chart performance, it will be a strong and clear threat to any bullish expectations. The latest performance confirms the strength of our permanent expectations of selling the pair from every higher level. The closest resistance levels for the pair are now at 1.3220, 1.3300, and 1.3430, respectively.

For the second day in a row, the economic calendar has no important and influential data, whether from Britain or the United States of America.