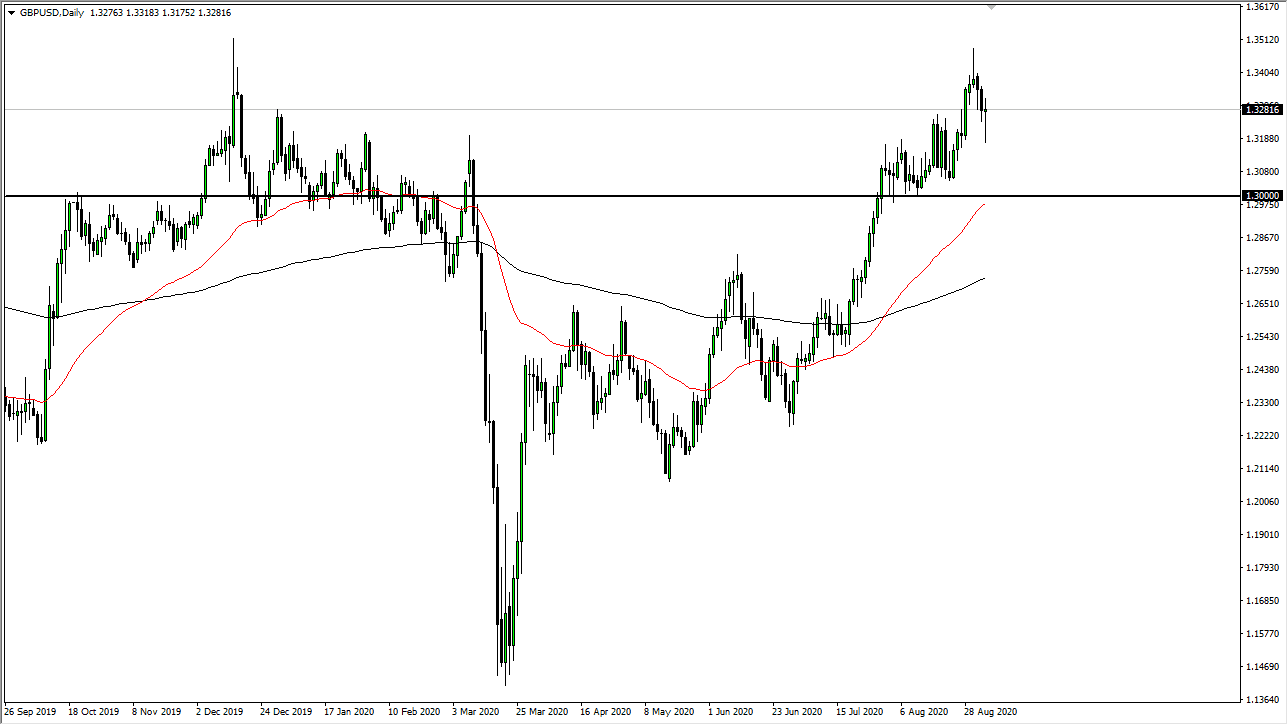

GBP/USD: Break below 1.3250 area may be significant

Last Thursday’s signals were not triggered as the bullish price action took place below the support level identified at 1.3253.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be entered before 1 pm London time today.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3258 or 1.3320.

- Put the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3180 or 1.3115.

- Put the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote last Thursday that the support level at 1.3253 was likely to be strong, both due to the length of time this area held as resistance and due to its confluence with the major quarter-number at 1.3250.

I was looking for a long trade in that area, but this did not set up. It was not a profitable call, but it was enough to stay out of trouble.

The British Pound stands out today as the most relatively weak major currency. The price has broken down below the 1.3250 area and appears to be heading for the next support level below at 1.3180 which held at the end of last week and gave a bullish bounce. We are likely to see some kind of bullish bounce there, but with the USA on holiday, a long trade at a bounce there is probably better executed as a scalp.

The price has a very high chance of hitting 1.3180 today.

As volume will be very thin later, it will probably be a good idea not to enter any trades after 1 pm London time.

There is nothing of high importance due today regarding either the GBP or the USD. It is a public holiday today in the U.S.A.