GBP/USD: Pound one of the strongest major currencies

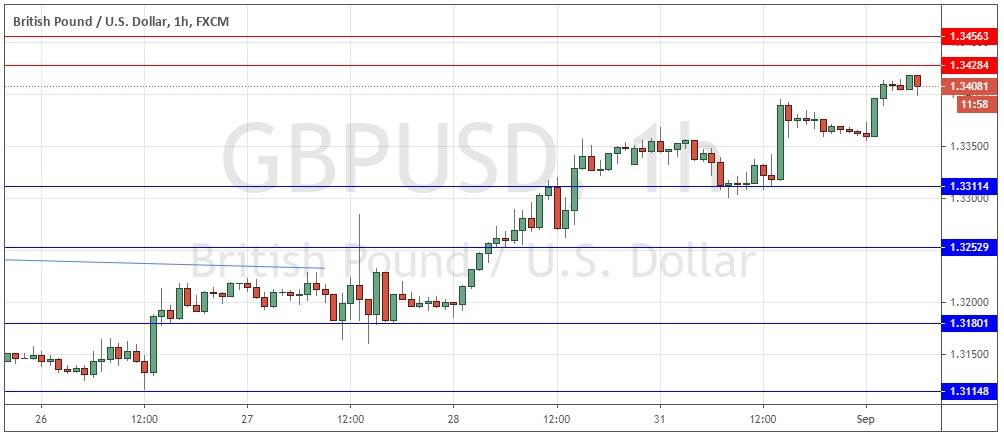

Last Thursday’s signals produced a very profitable long trade from the bullish rejection of the support level identified at 1.3180 after the failure of a short trade from the bearish rejection of the resistance level at about 1.3233.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today only.

Short Trade Ideas

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3428, 1.3456, or 1.3559.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Long Trade Idea

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3311.

- Place the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote last Thursday that I thought the best opportunity would come from a short trade between 1.3200 and 1.3300 approximately. However, I also said that if the price could break up above 1.3305 and hold up there, that would be a very bullish sign and take the price of this pair into blue sky with new long-term highs.

This was a fairly good call as after the remarks from the Federal Reserve the price initially seemed to make this bearish turn at the trend line rejection which I was watching out for, before making a strong bullish bounce at the support level of 1.3180.

Although the rise from there was slow over the remainder of the day, the bullish “blue sky” scenario eventually started to play out on Friday.

The price has continued to move up to new long-term high prices, but now faces a couple of resistance levels nearby.

The Pound is one of the strongest major currencies and that is another bullish sign in addition to the bullish momentum that we are seeing now.

I will take a bullish bias on this currency pair today if we get two consecutive hourly closes above 1.3456. Concerning the USD, there will be a release of ISM Manufacturing PMI data at 3pm London time. There is nothing of high importance due today regarding the GBP.

Concerning the USD, there will be a release of ISM Manufacturing PMI data at 3pm London time. There is nothing of high importance due today regarding the GBP.