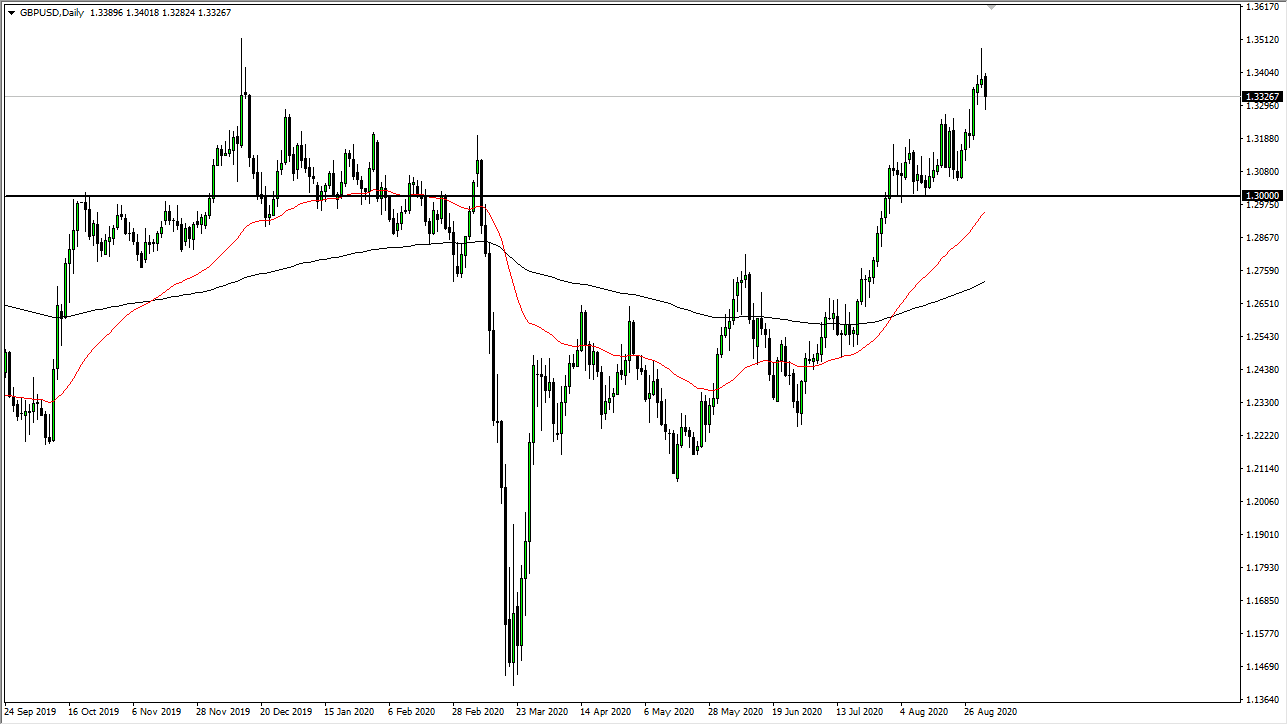

GBP/USD: Support at 1.3253 looks strong

Yesterday’s signals were not triggered, as the bullish price action took place below the support level identified at 1.3311.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be taken between 8 am and 5 pm London time today only.

Short Trade Ideas

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3370 or 1.3402.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3253 or 1.3180.

- Place the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote yesterday that long trade entries could still be interesting today, and happily, the two support levels we saw at 1.3311 and 1.3253 looked strong.

This was not such a great call as the price continued to fall to break below 1.3311, but it was enough to keep out of trouble. The level at 1.3253 has not been reached yet.

It is clear that the U.S. Dollar is strong, but the Pound is not the worst loser against it.

I still see the support level at 1.3253 as likely to be strong, both due to the length of time this area held as resistance and due to its confluence with the major quarter-number at 1.3250.

I will take a long trade if the price reaches this level later today and makes a bullish bounce there at the first touch.

We are likely to see relatively little price movement today, with the major move likely to come tomorrow after non-farm payrolls data is released.

Concerning the USD, there will be a release of ISM Non-Manufacturing PMI data at 3pm London time. Regarding the GBP, the Governor of the Bank of England will be speaking at the same time.