The British pound delved during the trading session on Thursday, as the EU has threatened legal action now if the United Kingdom does in fact simply walk away from the trade agreement. That being said, we are now fully back in the same drama we were in a couple of years ago, and therefore trading the British pound is going to be risky to say the least. Ultimately, you are going to need to cut your position size quite drastically, because the British pound will continue to move on the latest rumor, headline, or the occasional Tweet. In other words, get ready for more manipulation and drama.

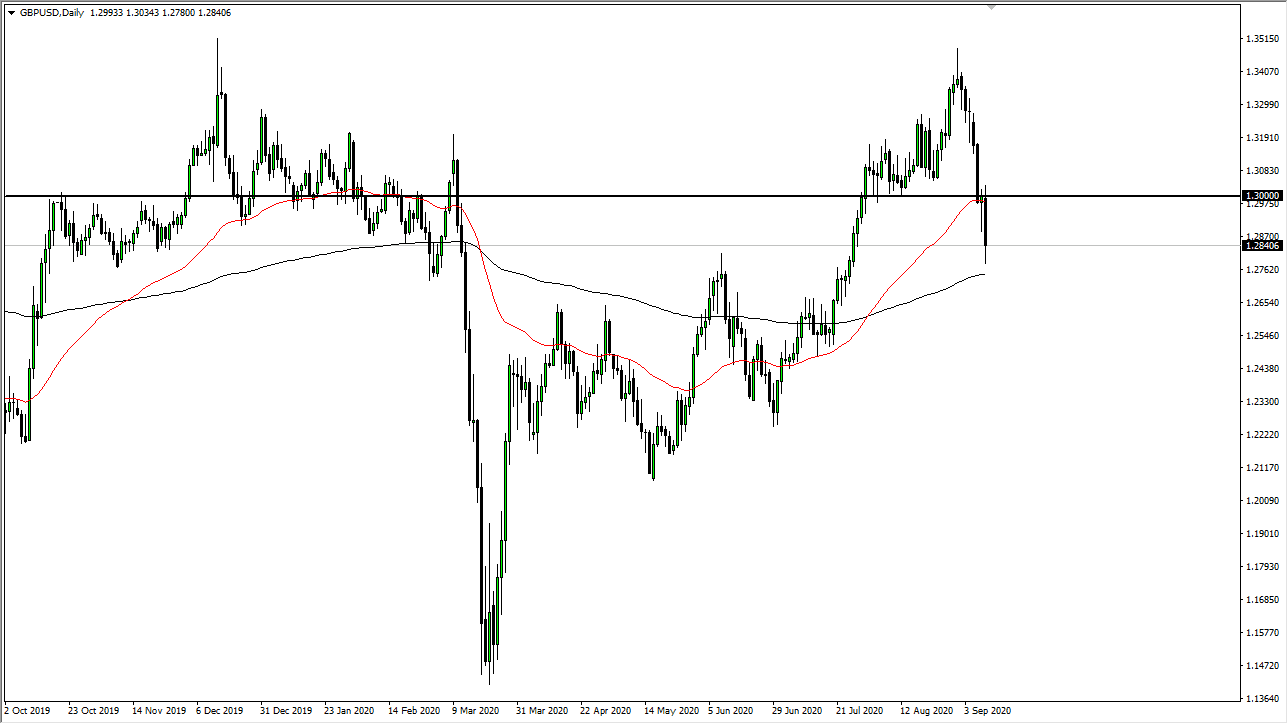

Looking at this chart, you can see that the market bounce from just above the 200 day EMA, showing signs of at least some stability. Previously, I had mentioned that we could go down to the 1.2750 level, and we have gotten pretty close to that level. So, the question now is what happens next? At this point in time, the market is likely to continue to be very noisy, and at this point in time it is likely to continue to be very difficult to trade. You need to keep your position size about half of what you normally would. This is because your stop losses are going to have to be huge, but the one good piece of news is going to be the fact that the gains will probably be rather large when you are correct as well. Nonetheless, if you remember back when Brexit drama was gripping the headlines every other day, there were a lot of traders out there blowing up their accounts.

The size of the candlestick does in fact suggest that we should see a little bit of confirmation and continuation to the downside, but it is only a matter of time before buyers will probably come back in as well, as we had gotten a bit overstretched. Unfortunately, this is a market that still has plenty of buyers underneath, so having said that you really cannot put a lot of faith into anything. I anticipate that Friday will be somewhat negative, but before we go into the weekend there will be a certain amount of profit-taking by the short-sellers. Do not be surprised at all to see this market turn right back around at the slightest hint of positivity between the EU and UK.