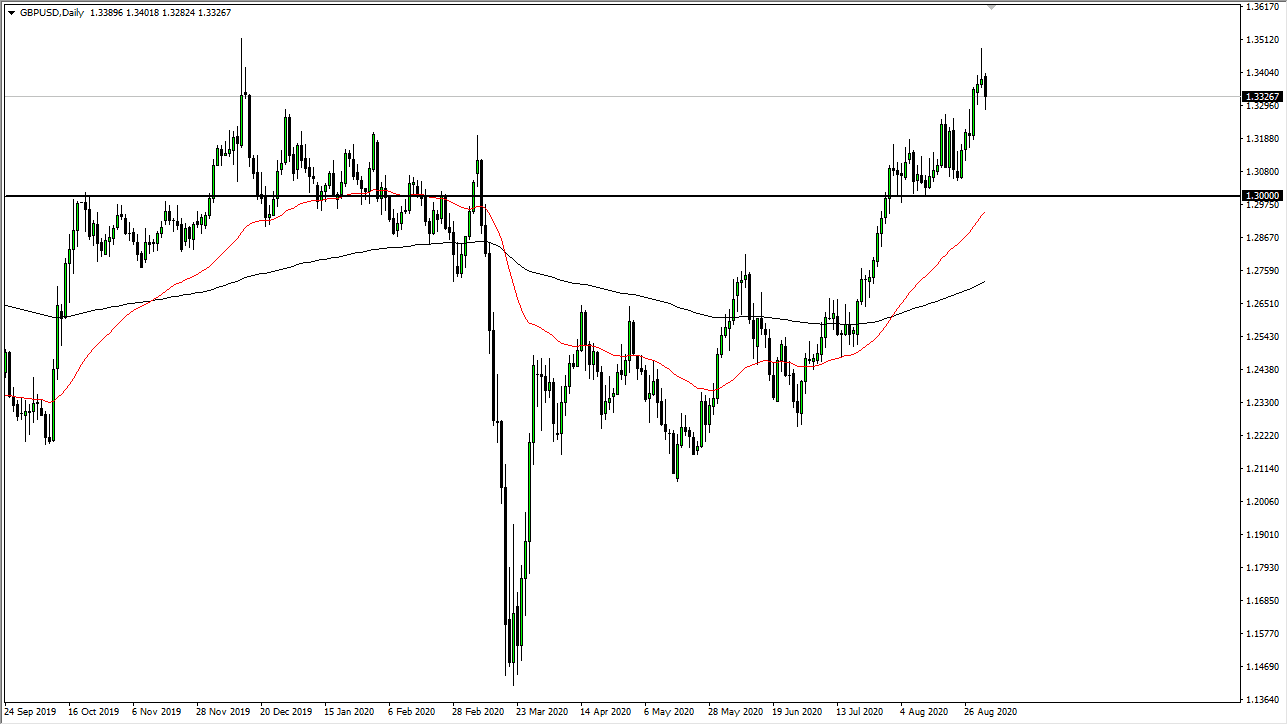

The British pound fell hard during the trading session on Wednesday but turned around to show signs of survival and resiliency as we bounced above the 1.33 level yet again. Ultimately, this is a pair that is probably going to be very jittery towards the end of the week as the Non-Farm Payroll numbers come out on Friday, and it will more than likely cause significant reactions in the US dollar. This pair has been moving based upon the Federal Reserve and its actions more than anything else. As the Federal Reserve continues to flood the markets, it makes sense that the US dollar would lose a bit of value.

That being said, it is obvious that the market had gotten a bit ahead of itself so it is not a huge surprise that the market would pull back from the 1.35 handle, which is a large, round, psychologically significant figure and an area that had previously been a target of mind. Having said that, that does not mean we will pull back a bit over the next day or two, but I think those continue to offer buying opportunities, especially if you take a look at the way the market reacted on Wednesday. I do believe that the 1.30 level underneath continues to be a massive support level, as it was previous resistance. All things being equal, the 50 day EMA sits just below there as well, so, therefore, I think there is at least a couple of reasons for buyers to be interested in getting involved in the dip.

I like the idea of picking up value every time it shows itself, and I think that it is likely that we will see the jobs number cause chaos in the market, but ultimately, we should see a continuation of the overall trend. If the jobs numbers are bad enough that will send money running away from the US dollar as it will almost certainly have the Federal Reserve doing something in the short term to pick up the slack in the economy. If we can break above the 1.35 handle, then it is likely the British pound will continue to go towards the 1.40 level which is the next major target based upon longer-term analysis and the large, round, psychologically significant figure that a lot of traders will be paid attention to.